CRED iQ: Commercial Loan Modifications Surged in 2023

(Image courtesy of CRED iQ)

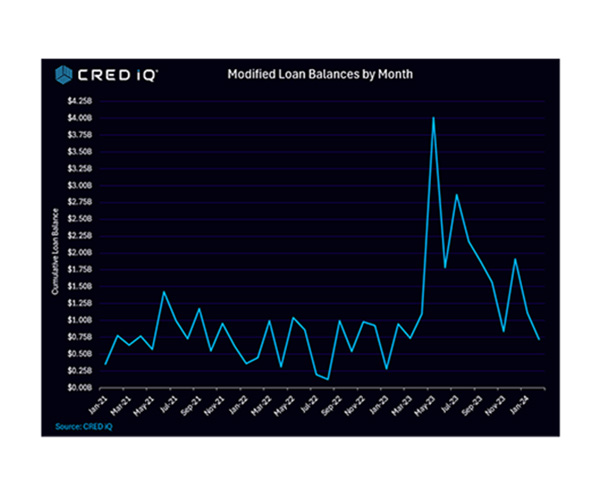

CRED iQ, Wayne, Pa., reported the number of commercial loan modifications jumped significantly in 2023 from 2022. And, the firm anticipates that trend will persist in 2024.

Of the $162 billion in securitized commercial mortgages that matured in 2023, 542 loans were modified with cumulative balances of more than $20 billion, up 150% from the number of 2022 modifications.

CRED iQ’s 2024 CRE Maturity Outlook anticipates this year will see $210 billion in securitized maturities, and the modification trend will continue as more special servicers decide to “pretend and extend” on the properties rather than consider some sort of foreclosure action.

Within the office sector, only 26% of the almost $36 billion of office CMBS loans that matured last year was paid off in full.

The most popular specific modification has been an extension at 32% in 2023 and 26% in 2024 year-to-date.

In 2023, 15% of loans saw a combination of modifications, 3% were in forbearance and 2% had a temporary rate reduction. The other 48% fell into the “other” category.

Year-to-date for modifications in 2024, 24% were other, 17% were in forbearance and 33% were a combination.