Urban Land Institute: 2024 Will Continue to See Challenges, but Optimism Ahead

(Image courtesy of ULI; Breakout image courtesy of _ quietbits _/pexels.com)

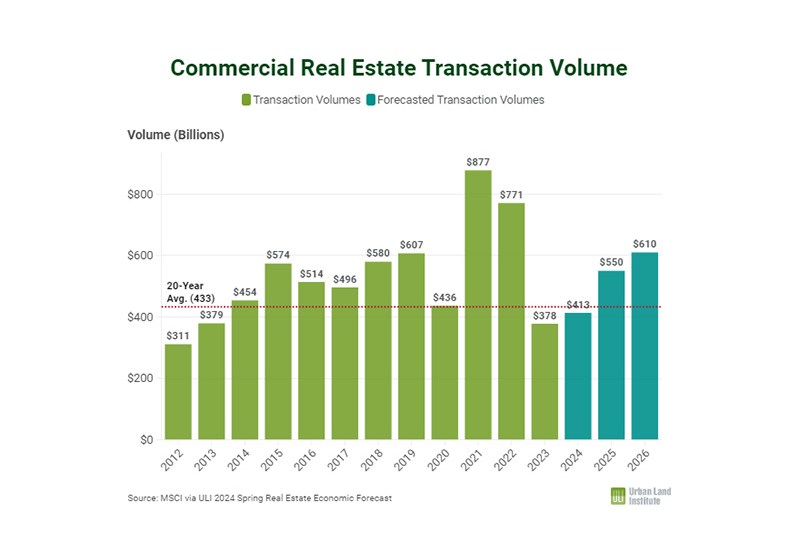

The Urban Land Institute, Washington, released its Real Estate Economic Forecast for Spring 2024. Among the major takeaways–while 2024 is seeing a solid economy, high interest rates continue to weigh on the industry.

But, ULI noted, the industry should begin to make up ground in 2025 and 2026.

“The forecast for 2024 reflects some caution, as capital market constraints are expected to continue to be a challenge for longer than previously anticipated, influencing return forecasts. Overall, though, the industry is poised for a slow and steady rise over the following two years,” said Anita Kramer, Senior Vice President of ULI’s Center for Real Estate Economics and Capital Markets.

Negative valuations are expected to put downward pressure on returns for different property types over the forecast period, ULI said.

Retail properties are anticipated to stay strong, at 4.6% average returns annually. Retail is followed by industrial (3.3% returns) and multifamily (3.2% returns).

However, office properties are anticipated to have an average annual return of less than 1.9% until 2026.

As for average annual rent growth by property type over the next few years, industrial is expected to see the best growth, with retail close behind. Multifamily properties lag 20-year average performance, with a 2% expected annual rent growth. And, offices are expected to contract by 1.1%.

The hotel industry has regained stability, ULI said, with predictions occupancy rates will remain strong and see slight growth in 2005 and 2006.

Additionally, housing construction is anticipated to remain strong, including single-family housing. Projections indicate housing starts will reach 970,000 in 2024, 1 million in 2025 and 1.1 million in 2026.