Redfin: Florida, California Homeowners See More Insurance Changes

(Image courtesy of Redfin; Breakout courtesy of Aathif Aarifeen/pexels.com

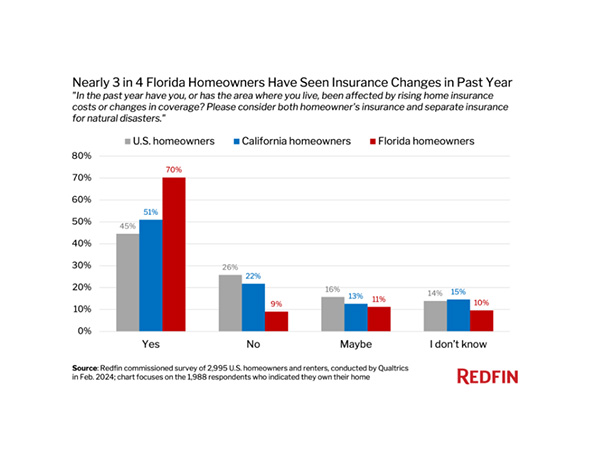

Redfin, Seattle, recently reported 70.3% of Florida homeowners and 51% of California homeowners say they or the area they live in have been affected by rising home insurance costs or changes to coverage over the past year.

In contrast, 44.6% of homeowners nationwide gave the same answer.

“Homeowners living in areas where insurance premiums are surging are at risk of seeing their properties gain less value than homeowners in areas with stable premiums—and in some cases, they may even lose money,” said Redfin Chief Economist Daryl Fairweather. “Homes with low disaster risk and low insurance costs will likely become increasingly popular, and thus more valuable, as the dangers of climate change intensify.”

In Florida, 11.9% of survey respondents who plan to move in the next year pointed to rising insurance costs as a reason, compared with the national share of 6.2%. In California, 13.1% of people who intend to relocate in the next year listed natural disasters or climate risk, compared with 8.8% nationwide.

In Florida, 12% of respondents who replied “yes” or “maybe” to being impacted/living in an area that has been impacted by changes in insurance cost or coverage said their insurance company stopped offering coverage for their home. In California, that figure was 10.7%; nationwide it’s 8.3%.

Moreover, 27.7% of those respondents in Florida said they are or have been concerned their insurer may stop offering coverage for their home. In California, it’s 13.5%; nationwide it’s 8.9%.