CommercialEdge: Q1 Office Sales Dip 17% From 2023

(Image courtesy of CommercialEdge; Breakout image courtesy of Polina Zimmerman/pexels.com)

CommercialEdge, Santa Barbara, Calif., reported Q1 office sales fell to $5.4 billion, 17% below the 2023 first-quarter result.

Assets traded at $171 per square foot.

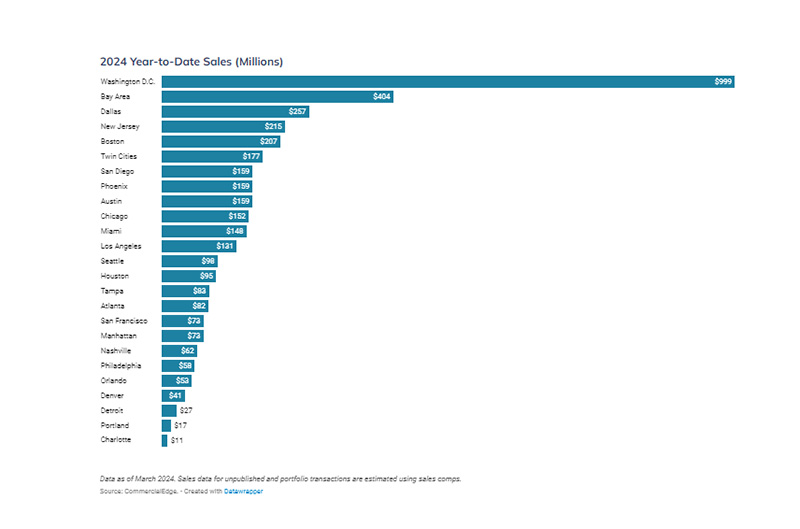

Washington, D.C., saw the largest chunk of sales in the U.S., with transactions at $999 million in the quarter.

The average listing rate was at $37.74 per square foot in March, falling 1.3% year-over-year.

The national office vacancy rate was at 18.2%, up 120 basis points year-over-year.

By the end of March, under-construction office space stood at 87.9 million square feet. However, only 2.8 million square feet broke ground this year.

Boston’s under-construction pipeline made up more than 15% of the national stock currently underway.

In terms of other trends, CommercialEdge noted that the geographic makeup of co-working spaces is beginning to trend more suburban. The amount of flex space the firm has recorded grew from 113.5 million square feet to 124.8 million square feet–and nearly all of that has been in the suburbs.

This comes amid continued conversations over hybrid, remote and in-person work, with some companies avoiding traditional office spaces in favor of more varied options such as co-working.

“Co-working operators are bringing the office to the worker rather than waiting for the worker to commute to them by adding significant space closer to where people live in the suburbs,” noted Peter Kolaczynski, Director, CommercialEdge.