MCT Finds Lock Volume Increase Heading Into Buying Season

(Illustration courtesy of MCT)

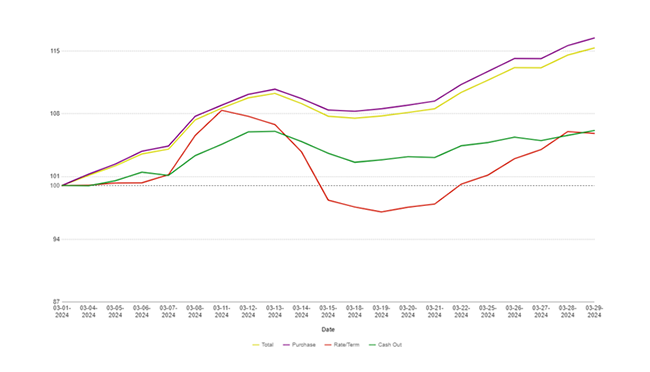

Mortgage lock volume increased 15% between February and March, according to Mortgage Capital Trading, San Diego.

MCT’s April mortgage lock volume report said mortgage lock volume is continuing its upward trajectory as we enter the buying season.

“Although rates currently stand at 7%–historically high compared to recent years–they are expected to decline, enticing buyers to make purchases now with the anticipation of refinancing when rates begin to drop,” the report said.

Though recent months have seen a steady rise in lock volume, MCT noted volumes remain on the lower end of the scale, resulting in perceived significant month-over-month increases. The lock volume indexes reveal an 8% year-over-year increase, predominantly fueled by a 44% surge in refinances compared to this time last year. “Even amidst the challenges posed by higher rates, we continue to witness incremental increases in lock volume,” said Andrew Rhodes, senior director and head of trading at MCT. “Market expectations indicate a 50% chance for a rate cut in June. However, robust economic data in the coming months may delay rate cuts until July or September, potentially resulting in sideways or even lower production.”