Delinquency Rates for Commercial Properties Flat in First Quarter of 2024

(Image courtesy of MBA)

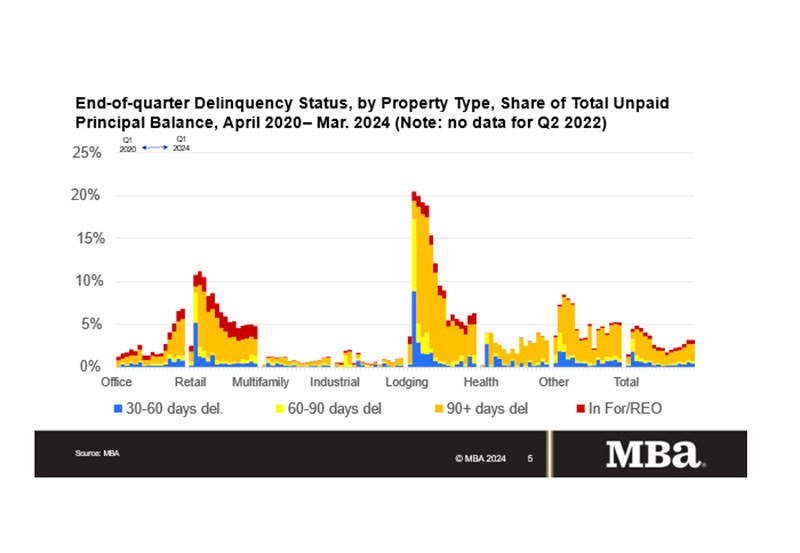

Delinquency rates overall for mortgages backed by commercial properties were unchanged during the first quarter of 2024, but loans backed by office properties continued to see a rise in delinquencies. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance (CREF) Loan Performance Survey.

“While overall delinquencies remained flat, the delinquency rate for loans backed by office properties rose again during the first three months of this year,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Loans across property types are adjusting to higher interest rates and uncertainty about property values, but the continued fog around the impact of hybrid work adds another challenge for office properties and their loans.”

Woodwell continued, “The commercial real estate market is large and diverse, with a wide mix of property types, geographic markets and submarkets, property and loan sizes, owners, lenders, vintages, and other characteristics. With 20% of the $4.7 trillion of outstanding commercial mortgage debt maturing this year, each of those factors will play a part in determining which loans may face challenges and which may not.”

The balance of commercial mortgages that are not current was unchanged in first-quarter 2024 (compared to Q4 2023).

96.8% of outstanding loan balances were current or less than 30 days late at the end of the quarter, unchanged from the previous quarter.

• 2.5% were 90+ days delinquent or in REO, up from 2.3% the previous quarter.

• 0.3% were 60-90 days delinquent, unchanged from the previous quarter.

• 0.4% were 30-60 days delinquent, down from 0.6%.

Loans backed by office properties drove the increase.

• 6.8% of the balance of office property loan balances were 30 days or more days delinquent, up from 6.5% at the end of last quarter.

• 6.3% of the balance of lodging loans were delinquent, up from 6.1%.

• 4.7% of retail balances were delinquent, down from 5.0% the previous quarter.

• 1.2% of multifamily balances were delinquent, unchanged from the previous quarter.

• 1.2% of the balance of industrial property loans were delinquent, up from 0.9%.

Among capital sources, CMBS loan delinquency rates saw the highest levels.

• 5.2% of CMBS loan balances were 30 days or more delinquent, up from 5.1% last quarter.

• Non-current rates for other capital sources remained more moderate.

– 0.8% of FHA multifamily and health care loan balances were 30 days or more delinquent, down from 0.9%.

– 1.2% of life company loan balances were delinquent, up from 0.9%.

– 0.4% of GSE loan balances were delinquent, down from 0.5%.

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of March 31, 2024. This quarter’s results build on similar surveys conducted since April 2020. Participants reported on $2.7 trillion of loans in March 2023, representing 57% of the total $4.7 trillion in commercial and multifamily mortgage debt outstanding (MDO).

For more information on MBA’s CREF Loan Performance Survey, please visit: www.mba.org/store/products/research/general/report/commercial-real-estate-finance-loan-performance-survey.