Home Affordability Difficult for Average Incomes, ATTOM Finds

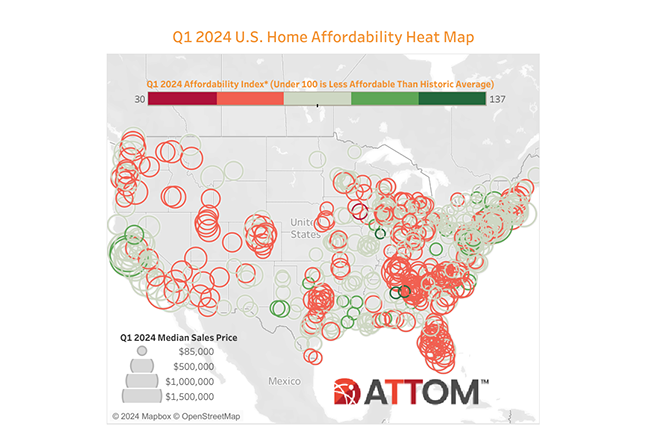

(Illustration courtesy of ATTOM)

Median-priced single-family homes and condos remain less affordable than historical averages in more than 95 percent of U.S. counties, according to ATTOM, Irvine, Calif.

The trend continues a pattern that dates to 2022 of home ownership requiring historically large portions of wages around the country, the ATTOM first-quarter 2024 U.S. Home Affordability Report found.

The report also found that major expenses on median-priced homes consume 32.3 percent of the average national wage in the first quarter, several points above common lending guidelines.

Both measures represent slight quarterly improvements but remain worse than a year ago and sit at levels that have worked against home buyers for three years. “That scenario has continued as increases in home values and major home-ownership expenses have outpaced gains in wages, despite a small respite from the second half of last year into the first quarter of 2024,” ATTOM said.

As a result, the portion of average wages nationwide required for typical mortgage payments, property taxes and insurance is up nearly three percentage points from a year ago and 11 points from early in 2021, right before mortgage rates began shooting up from their lowest levels in decades. The latest expense-to-wage ratio continues to sit above the 28 percent level preferred by mortgage lenders and marks one the highest points over the past decade.

“For sure, it’s not like things are coming up roses for house hunters. Affording a home remains a financial stretch, or a pipe dream, for so many households,” ATTOM CEO Rob Barber said. But he noted that mortgage rates have come down slightly from 2023 levels and home prices have grown only by modest amounts since then. “The upcoming spring buying season will say a lot about whether home prices remain stable enough for this trend to continue.”