Snapdocs Survey: eClosing Tech Investment Outpaces Adoption

(Image courtesy of Snapdocs)

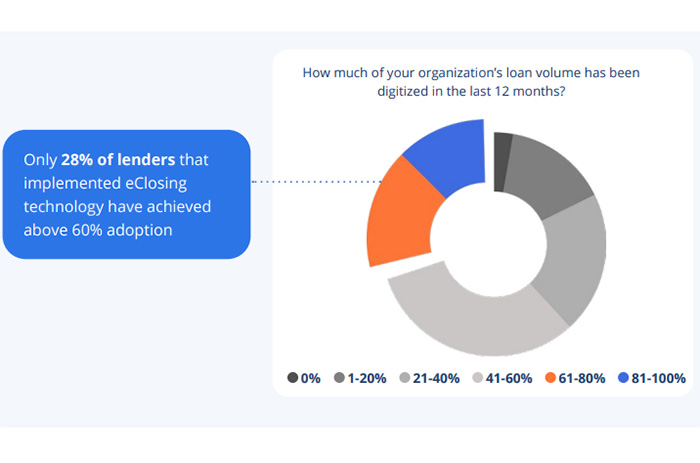

Digital closing provider Snapdocs, San Francisco, conducted a survey on lenders’ use of eClosing technology. It found that 74% of lenders have invested in the tech, but only 28% of those offering such services have achieved an adoption rate over 60%.

However, when asked about technology goals, 60% of respondents said they are interested in driving greater adoption of eClose over the next year, and 89% have defined eClosing goals.

Factors limiting adoption include technology costs, security and compliance, integration issues and staff training.

“Attaining high eClose adoption at scale requires more than just offering capable technology,” said Snapdocs CEO Michael Sachdev. “The lenders we see achieving success and maximizing the value of digital closings are those that identify the proper strategy, prioritize change management and meticulously evaluate eClose providers.”

The survey, of 100 top mortgage lenders, found “hybrid,” (defined as when both digital and nondigital elements are incorporated for signing, usually with an in-person closing appointment) is the most common type offered, at 62%. The next most common setup is “wet,” where a borrower previews all closing documents digitally but attends an in-person meeting to wet-sign the full closing package, at 53%.

Only 11% of lenders offer full eClosing.

The survey also found that global and national banks are more likely to offer hybrid closings and eNotes (an electronic promissory note). Regional/community banks, credit unions and nonbank lenders are more likely to offer wet closings.