Builder Confidence Drops in September, NAHB Reports

(HMI image courtesy of NAHB)

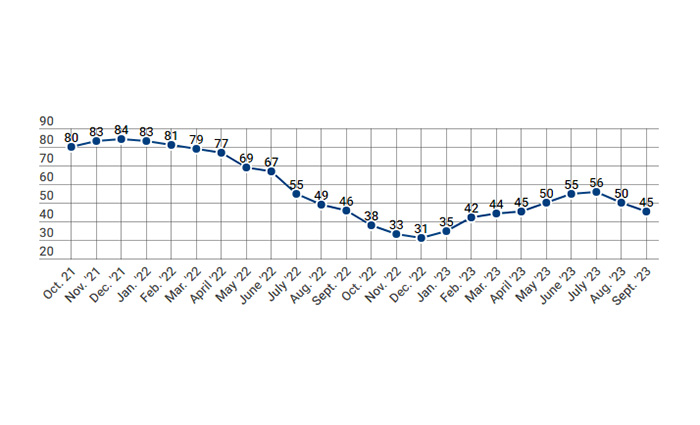

High mortgage rates are continuing to erode builder confidence, the National Association of Home Builders, Washington, D.C., reported, noting the sentiment levels dropped below the break-even measure of 50 for the first time in five months.

Per the NAHB/Wells Fargo Housing Market Index for September, builder confidence fell to 45, down five points. There was a six-point drop in August.

“High mortgage rates are clearly taking a toll on builder confidence and consumer demand, as a growing number of buyers are electing to defer a home purchase until long-term rates move lower,” said NAHB Chief Economist Robert Dietz. “Putting into place policies that will allow builders to increase the housing supply is the best remedy to ease the nation’s housing affordability crisis and curb shelter inflation. Shelter inflation posted a 7.3% year-over-year gain in August, compared to an overall 3.7% consumer inflation reading.”

Builders are cutting prices to promote sales amid the high-interest-rate environment, NAHB reported. In September, 32% of builders reported cutting home prices—the largest share since December 2022.

The average price discount is at 6%, and 59% of builders provided sales incentives of all forms in September, the most since April.

“The two-month decline in builder sentiment coincides with when mortgage rates jumped above 7% and significantly eroded buyer purchasing power,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “And on the supply-side front, builders continue to grapple with shortages of construction workers, buildable lots and distribution transformers, which is further adding to housing affordability woes. Insurance cost and availability is also a growing concern for the housing sector.”

Also of note: a special question in the September index found that 42% of new single-family home buyers were first-time buyers on a year-to-date basis. That’s up significantly from a “more normalized” market in 2018, NAHB said.