Freddie Mac: Apartment Investment Market Index Rises Again in Second Quarter

(Courtesy Freddie Mac Multifamily, McLean, Va.)

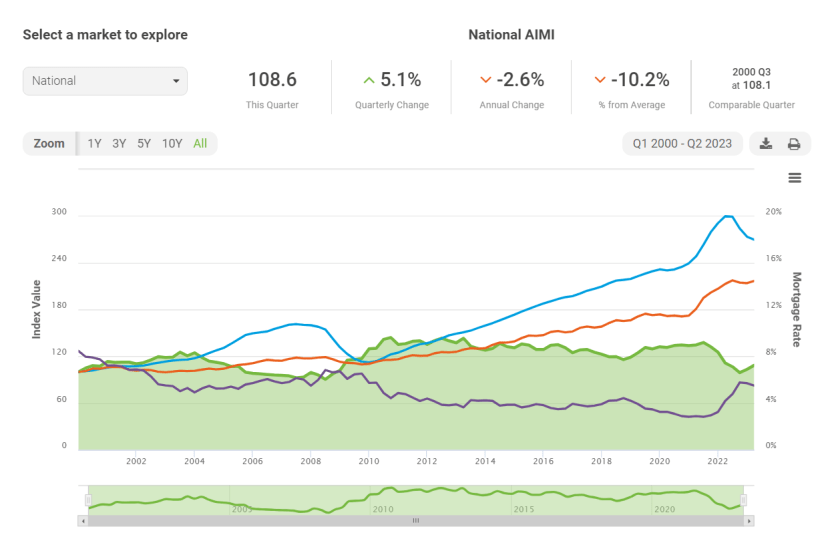

Freddie Mac Multifamily, McLean, Va., said its Apartment Investment Market Index rose by 5.1% in the second quarter, marking the second straight quarter the index improved nationwide and in all 25 markets examined.

Year-over-year, the index decreased nationally and in 23 of 25 markets studied, although this quarter’s drop of -2.6% year over year was significantly smaller than last quarter’s national annual drop of -17.6%, Freddie Mac said.

“This quarter’s results show that AIMI is rebounding,” said Sara Hoffmann, director of Multifamily Research at Freddie Mac. “The index experienced a sharp annual decline in each of the prior four quarters, but a pullback in property prices and moderating mortgage rates are helping AIMI regain its footing.”

Hoffman noted the index increased over the past quarter “due to the confluence of net operating income growth, property price depreciation and lower mortgage rates relative to recent trends.”

The second quarter’s national growth rate is the highest since the third quarter of 2019, the report said. This quarter:

• Net Operating Income increased in the nation and in most markets. No markets were deeply negative, with the lowest performer being Phoenix at -0.8%.

• Property prices dropped in the nation and in all but two markets, Miami and Nashville. However, these two markets saw minimal growth of 0.1% and 0.5%, respectively.

• Mortgage rates dropped by 20 basis points. This is the largest quarterly decrease since the first quarter of 2020.

Over the past year, the index decreased in the nation and in 23 markets. Last quarter, the national annual drop was -17.6%, compared with -2.6% this quarter. Year over year:

• NOI growth was mixed. Nationally, NOI grew by 1.8% but nine markets experienced declines.

• Property prices declined for all markets, and prices nationally contracted by 10.1%. The national price decline is only the second annual decline since the second quarter of 2010.

• Mortgage rates increased by 131 basis points. This is high by historical standards, but considerably lower than last quarter’s 246 basis point annual increase.