Sponsored Content From CreditXpert: How to Keep Credit Scores from Robbing You of New Mortgage Lending Business

By Mike Darne, Vice President of Marketing, CreditXpert

A borrower’s credit report provides a valuable snapshot of their financial health. Mortgage lenders have been using it for years to underwrite their deals, credit is, the most dynamic of the 3 Cs of lending, and it has proven a reliable source of data to predict loan performance. But it can be more than that if the lender learns not to take the borrower’s credit at face value.

As a data science company, we know that taking credit at face value can cause lenders to overlook hidden opportunities and deprive borrowers of more affordable financing.

Recent data gleaned from an analysis of millions of consumer credit scores has revealed that the majority of borrowers (over 70%), regardless of their initial credit score, can improve their credit score by at least 20-points within 30 days.

This highlights the importance of engaging applicants about their credit from the very beginning to unlock their full mortgage potential. We’ll tell you how the data convinced us of this conclusion in this article.

Opportunity is hiding in the consumer’s credit.

Many people, including mortgage lenders, believe that a consumer’s credit score is written in stone. It’s a glimpse into what the data suggest on a given day, but it is mutable.

Many borrowers, especially those with low-to-mid-range scores, can raise their scores with relatively simple actions like paying down balances and resolving errors. They likely would want to remedy their errors, but don’t have the guidance to do so, or even know where to start.

Of the three big Cs of loan underwriting, the applicant’s capacity to repay; the value of the collateral; and the credit report, the latter is the only one anyone can have any real control over during the relatively short period of time during which the loan is being originated.

Let me say it again: credit is dynamic. You can and should look at every credit score not for what it is, but for what it could be. When you do, you can qualify more borrowers, offer better deals to those who do qualify and pay lower LLPA fees.

How big an opportunity is this for lenders?

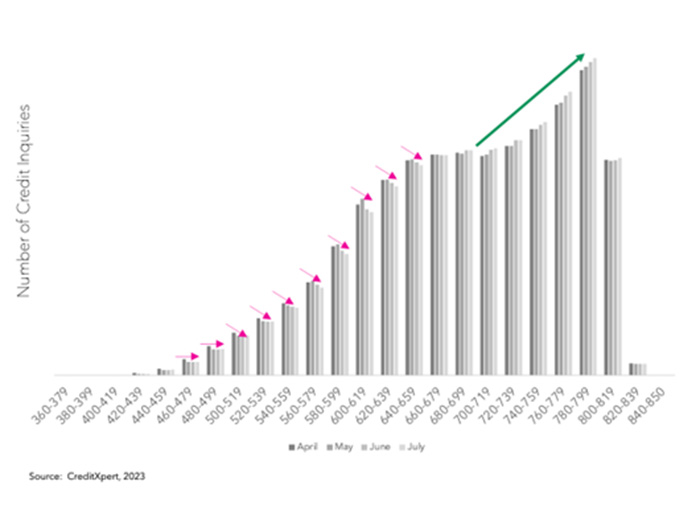

The Mortgage Credit Potential Index (MCPI) is a monthly reporting of mid-score mortgage credit pulls analyzed by CreditXpert’s predictive analytics platform. The MCPI highlights the volume of mid-score mortgage credit pulls by 20-point credit bands between 360 and 850. When compared to prior months and years, the MCPI serves as an indicator of changes in query volume.

What we’ve seen in past month’s MCPI and continue to see for more than 18 months now is that almost seventy percent of all borrowers, regardless of initial credit score, could improve their score by at least one 20-point credit band within 30 days.

Put another way, nearly 3 out of 4 loan applicants could raise their score in about 30 days, if they are provided a precise method for doing so.

Here’s what we saw in the July MCPI data.

CreditXpert’s MCPI data for the month of July 2023, shows clear shifts in mortgage demand for prospective borrowers at both the lower end of the credit spectrum and those with higher scores.

Demand, as a percentage of total demand, among borrowers with credit scores in the low– to mid-credit score bands (679 and below) has been decreasing since April 2023. On the other hand, borrowers with higher credit scores (700 – 799), exhibited increasing mortgage demand. This is clearly illustrated in Figure 1 below.

Figure 1

Change in Credit Inquiries April – July 2023

We expect to continue to see demand for new mortgage credit in the higher credit score bands, especially if the Fed stops raising interest rates as MBA’s chief economist Mike Fratantoni has recently predicted.

These are the borrowers who have the most capacity to invest in new homes. Unfortunately, these are the mortgage deals that everyone is competing to win.

The real value for the lender who wants to find new business is further down the credit spectrum.

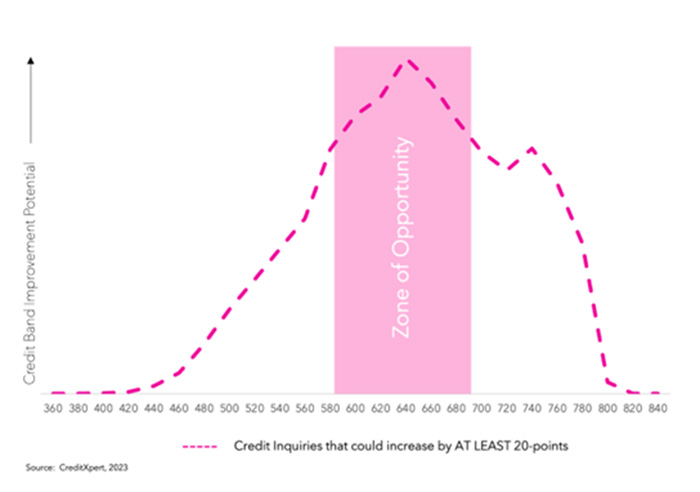

Our analysis of the most recent data suggests that lenders have a significant opportunity to help borrowers improve their credit score in a lower set of bands. These are the borrowers that have the most potential to increase their scores.

We call that hidden opportunity “potential energy” and have highlighted it in Figure 2 below as the “zone of opportunity.” Simply put, the “zone of opportunity” represents the range of credit bands where borrowers have the greatest opportunity to improve their credit score within a 30-day timeframe.

The graph below represents those credit inquiries in the month of July that can improve by at least one 20-point credit band in a 30-day timeframe. As the line moves up on the vertical axis, so does the number of 20-point credit bands that the borrower can improve. The shaded area, the zone of opportunity, represents the bands where lenders have the greatest opportunity to help their borrowers increase their credit score, lower LLPA premiums and as a result, lower the cost of homeownership.

It’s easy to see that this Zone of Opportunity also correlates to where we are seeing month-over-month decreases in inquiry volume.

We have highlighted the Zone of Opportunity from the most recent MCPI in Figure 2 below. Notice that it extends from borrowers in the 580 band all the way up to the 680 band.

Figure 2

The Zone of Opportunity

Admittedly, borrowers who fall into these credit bands do not typically make up the largest segment of the lender’s business. However, these are the loans your competitors often don’t even see, giving you an advantage in the marketplace.

Here’s how helping loan applicants win more business for the lender.

Ultimately, it’s up to the consumer to follow the precise plan CreditXpert provides to increase their scores. But we know that consumers want to do what it takes to improve their score. In a recent study among those that had either obtained a purchase mortgage or refinanced, we saw that 69% of consumers who are given a plan for increasing their scores will follow through with it.

The numbers demonstrate that simply accepting credit scores at face value equates to lost business. Savvy lenders will look beyond the score to educate and empower applicants. Building financial capability also builds customer loyalty.

Credit scores are not stagnant. With the right engagement and education from trusted advisors, many more applicants can become qualified borrowers and more qualified borrowers can lower their cost of homeownership. This enhances outcomes for both lenders and consumers.

This means that taking the consumer’s credit score at face value is a mistake and can rob lenders of potential business.

(Sponsored content includes material submitted independently of the Mortgage Bankers Association and MBA NewsLink and does not connote an MBA endorsement of a specific company, product or service. For more information about sponsored content opportunities, contact Bill Farmakis at bill@jlfarmakis.com or 203/834-8832.)