Home Affordability Continues to Challenge Americans, ATTOM Says

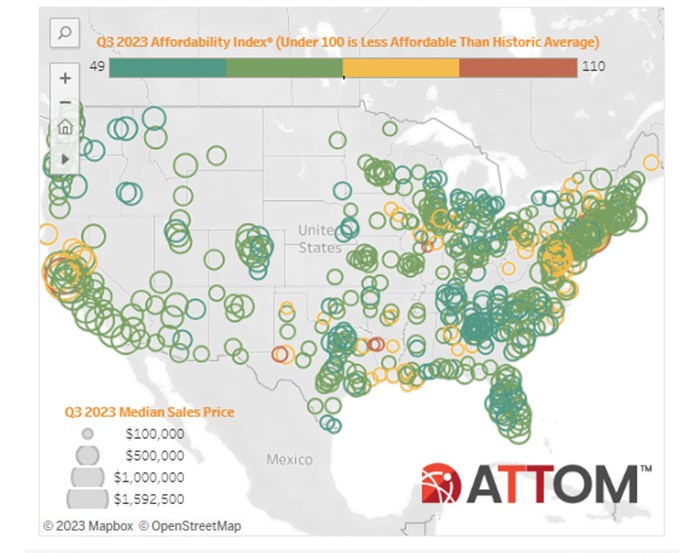

(Image courtesy of ATTOM; Interactive map below)

The ATTOM, Irvine, Calif., third-quarter 2023 U.S. Home Affordability Report revealed median-priced single-family homes and condos are less affordable compared with historical averages in 99% of counties where the firm had enough data to analyze.

Current conditions–including home prices–have pushed the typical portion of average wages needed for home-ownership expenses up to 34.6%, which is deemed unaffordable by common lending standards. Those standards look for a 28% front-end debt-to-income ratio.

This is also the highest mark since 2007. In early 2021, the average figure for expenses stood at 21%.

“The dynamics influencing the U.S. housing market appear to continuously work against everyday Americans, potentially to the point where they could start to have a significant impact on home prices,” said Rob Barber, CEO for ATTOM. “We clearly aren’t there yet, as the market keeps going up and the slowdown we saw last year looks more and more like a temporary lull. But with basic homeownership now soaking up more than a third of average pay, the stage is set for some potential buyers to be priced out, which would reduce demand and the upward pressure on prices. We will see how this shakes out as the peak 2023 buying season winds down.”

Compared with historical levels, ATTOM noted median home prices in 574 of the 578 counties it analyzed are less affordable than in the past. In the second quarter, 568 counties fell into that category, and 552 this time last year.

The cost of mortgage payments, homeowner’s insurance, mortgage insurance and property taxes on a median-priced single-family home was above $2,000 for the first time ever, at $2,053.

That consumes 34.6% of the average annual national wage of $71,214.

“While lenders will often push the 28% rule, especially if buyers have lots of financial resources outside of wages, we now are seeing fully three-quarters of markets around the country pushing the basic lending benchmark,” Barber said.

Moreover, annual price appreciation has outpaced weekly annualized wage changes from the third quarter of 2022 to present day in 272 of 578 counties. In the second quarter, wages were growing faster annually than prices, or shrinking less, in about 75% of those counties.