Data Center Construction Reaches Record High, Driven by AI Growth: CBRE

(Chart courtesy CBRE)

Demand for data center space overshadowed economic uncertainty and concerns around power availability in the first half of 2023, according to CBRE. Construction of North American data centers reached a record high in part due to the continued growth of artificial intelligence.

CBRE’s latest North American Data Center Trends Report found a total of 2,287 megawatts (MW) of data center supply currently under construction in primary markets, a record high. Last year at this time there was 1,830 MW under construction, the report noted.

More than 70% of the space under construction is already pre-leased. Companies are leasing space up to 36 months in advance of construction completion in anticipation of future demand and to secure data center space at current pricing, the report said.

“Data center construction is at an all-time high, driven by strong demand from all users, including AI, hyperscale and enterprise,” said Pat Lynch, executive managing director for CBRE’s Data Centers Solution. “New and existing uses of artificial intelligence cases grew tremendously in the first half of the year, and we expect demand to remain strong with AI driving leasing opportunities in the second half of the year.”

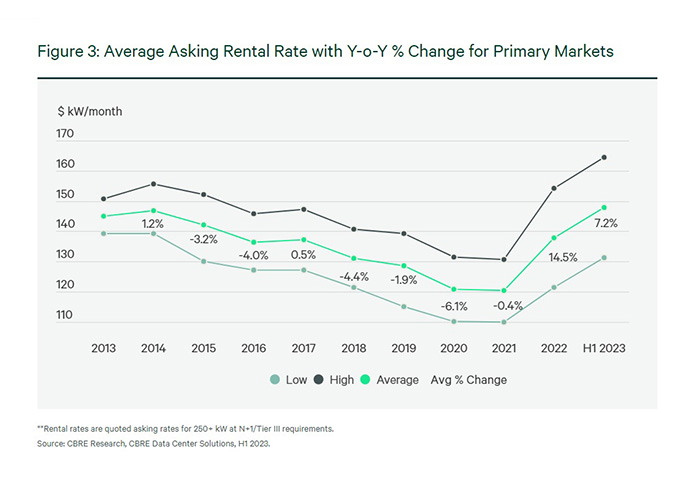

Absorption in the eight primary U.S. data center markets, Northern Virginia, Dallas-Fort Worth, Silicon Valley, Chicago, Phoenix, New York Tri-State, Atlanta and Hillsboro, Ore., remained resilient in the first half, totaling 468 MW despite challenges within the supply chain. While supply increased more than 19% year-over-year, vacancy remains near a record low 3.3%. “Strong demand paired with a lack of available power and extended timelines have kept asking rental rates climbing,” the report said, noting average primary market asking rents rose to $147.80 per kW/month from $127.50 (a 15.9% year-over-year increase).

“Most major markets are grappling with power constraints, and developers are facing challenges within their supply chain, but it’s not slowing down the demand for data center space,” said Gordon Dolven, director of Americas Data Center Research at CBRE. “Data center operators are prioritizing power availability, rather than selecting markets based on traditional factors such as location, connectivity, water and land pricing.”