Pending Home Sales Tumble

(Courtesy National Association of Realtors)

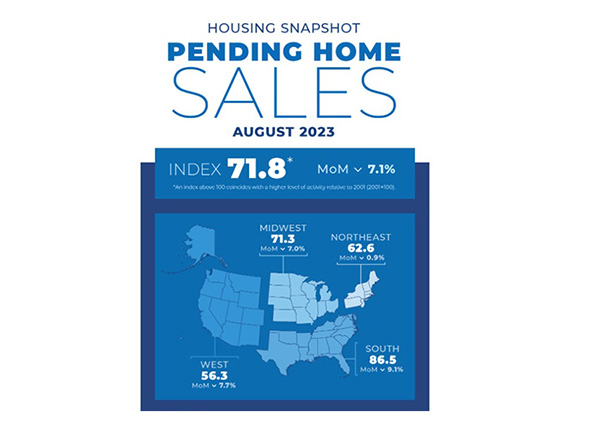

Pending home sales slid 7.1% in August, the National Association of Realtors reported Thursday.

All four U.S. regions posted monthly losses and year-over-year declines in transactions, NAR reported in its monthly Pending Home Sales Index.

“Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers,” NAR chief economist Lawrence Yun said. “Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.”

The Pending Home Sales Index is a forward-looking indicator of home sales based on contract signings. It sank 7.1% to 71.8 in August. (An index of 100 is equal to the level of contract activity in 2001.) Year over year, pending transactions fell by 18.7%.

First American Deputy Chief Economist Odeta Kushi noted pending home sales came in well below consensus expectations.

“Pending home sales generally leads existing-home sales by a month or two, so home sales are likely to remain close to the annualized rate of four million through the fall,” Kushi said. “The last time we went below 4 million was in the depths of the Great Financial Crisis between July and October 2010.” She blamed higher mortgage rates for the weakness in home sales.

“It’s clear that increased housing inventory and better interest rates are essential to revive the housing market,” Yun said.

Yun suggested the Federal Reserve should consider sharply decelerating rent growth in its consideration of future monetary policy. “There is no need to raise interest rates,” he said. “Moreover, the government shutdown will disrupt some home sales in the short run due to the lack of flood insurance or delays in government-backed mortgage issuance.”