ATTOM: Home Flipping Drops in Q2

(Image courtesy of ATTOM)

ATTOM, Irvine, Calif., found home flipping activity fell in the second quarter.

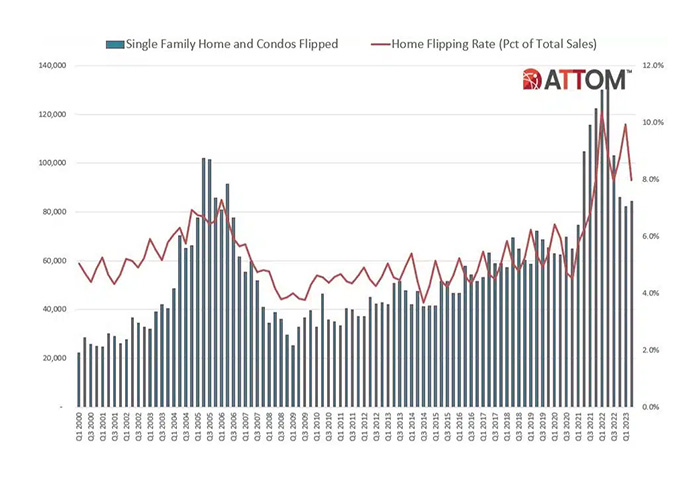

Per its second-quarter 2023 U.S. Home Flipping Report, 8% of single-family homes and condominiums were flipped in the second quarter. That’s down both from the first quarter (9.9%) and Q2 of 2022 (8.9%).

Overall, the flipping rate remains historically high, ATTOM noted, but it’s at one of its lowest spots since 2021. Investor profits and profit margins are starting to recover from a slump—investment returns climbed at the fastest pace since 2020 and raw profits shot up 18% quarterly.

“Fortunes for investors who flip homes for quick profits are showing more signs of turning around after a long and unusual period when they went down while the rest of the market went up,” said Rob Barber, CEO for ATTOM. “However, the latest investment returns may not be substantial enough to cover the holding costs on typical deals. And it’s still too early to declare the profit downturn over, as much will depend on whether the second-quarter market surge keeps going or whether it retreats again like it did last year.”

On a geographic basis, home flipping rates fell quarter-over-quarter in 168 of the 190 metropolitan statistical areas around the U.S. with enough data to analyze.

However, the largest flipping rates in the quarter were in Macon, Ga., at 16.8% of all home sales, Columbus, Ga., at 15.3%, Spartanburg, S.C., at 13.5%, Atlanta at 13.5% and Akron, Ohio, at 12.5%.

The smallest flipping rates were Seattle at 3.7%, Santa Rosa, Calif., at 4%, San Jose, Calif., at 4.2%, San Francisco at 4.3% and Hilo, Hawaii at 4.3%.

The percentage of flipped homes purchased in all cash fell in the second quarter—at 62.6%. That’s down from 66% in the first quarter, and roughly flat with the second quarter of last year (62.7%).

“The second-quarter dip in all-cash flips came during a brief period when mortgage rates were declining a bit after spiking during the prior year,” Barber said. “With rates now rising again, there will be more pressure on investors to use cash to finance their activity. The third quarter should reveal more about that trend.”

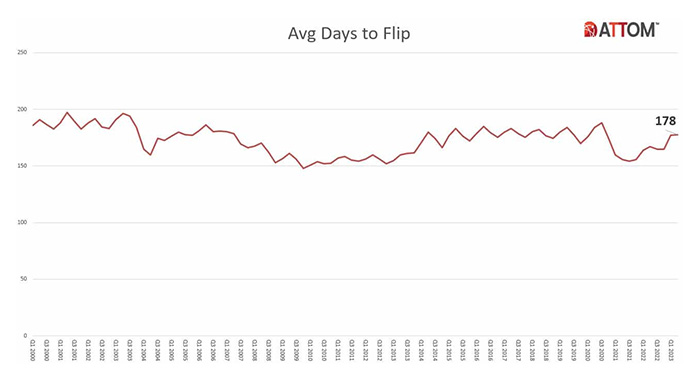

The average time from purchase to resale flips was 178 days during Q2, up from 177 days in the first quarter and 167 days in the same period last year.

Resales to FHA buyers hit a 3-year high, at 11.9%, up from 10.8% in Q1 and 7.6% in Q2 2022.