High Rates, Low Supply Drag Down Mortgage Volume in MCT October Indices Report

(Courtesy Mortgage Capital Trading)

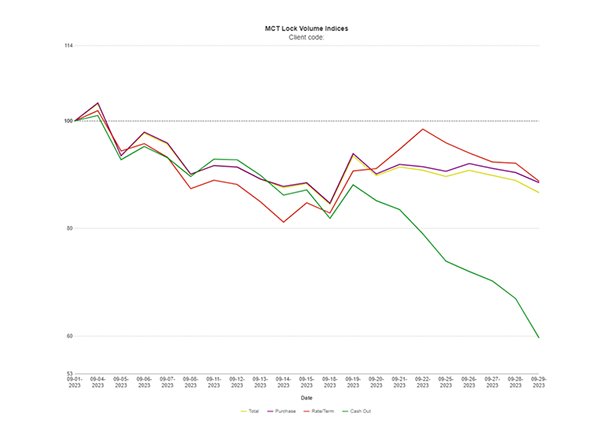

Mortgage Capital Trading, San Diego, found a significant 13.2% dip in mortgage lock volume in September.

Following the last month-over-month 4.76% drop, MCT attributed this downward trend in mortgage lock volume to an increase in mortgage rates throughout the last month to high sixes and low sevens. A lack of supply and unattractive housing values were secondary reasons, MCT’s October Indices Report said.

“We are hopeful that we will get some better sentiment from the Fed in either its November or December meeting, which would allow for some relief for rates,” said Andrew Rhodes, Senior Director and Head of Trading at MCT, “But without that, high interest rates will continue to be the prevailing force weighing on the market.”

The report said analysts will look for any shift in the Consumer Price Index and non-farm payroll figures, two indicators the Fed will look to as it makes its decisions for the rest of the winter and into early 2024. “As long as those numbers continue to stay strong or in line with the consensus, I believe the rates are going to stay where they are,” Rhodes said. “If we see a strong shift in either direction for CPI or non-farm payroll, that could mean we will either see an increase in rates or we will get more verbiage on pausing and it being close to terminal.”

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.