Milliman’s Ryan Huff: Does Loan Modification Help Borrowers?

Ryan Huff is a data scientist in Milliman’s Milwaukee office, where he specializes in predictive modeling and model validation related to the housing market. He works primarily on Milliman’s mortgage analytics platform M-PIRe, a cloud-based software that provides a complete end-to-end solution for evaluating direct mortgage investments, credit risk transfer, private mortgage insurance and insurance-linked notes. Huff received his master’s in economics from Marquette University.

Home values have been increasing across the United States, and increases in interest rates have pushed home affordability to the lowest level since at least the year 2000. Since the Global Financial Crisis, mortgage creditors (namely Freddie Mac and Fannie Mae) have been committed to helping distressed borrowers stay in their homes through loss mitigation programs. For example, the COVID-19 pandemic provided mortgage payment relief via forbearance to millions of homeowners during a time of great uncertainty.

With low levels of affordability, forbearance may not be sufficient to prevent future mortgage defaults and foreclosures, and alternative loss mitigation options may be required to help borrowers retain home ownership. Questions often asked in the industry on this topic are: what type and how much loss mitigation is required to prevent redefault?

To answer these questions, Milliman analyzed more than 100 million mortgages to evaluate redefault rates on loans that received loss mitigation between 2008 and 2012. Specifically, we analyzed redefault rates by the amount of payment reduction provided by various loss mitigation activities.

Identifying the population

Our analysis used loan performance data published by Fannie Mae and Freddie Mac. Starting from 105 million unique loans, the data was filtered down to 12 million loans that had a record of delinquency, as indicated by ever missing a monthly payment. We further narrowed the scope to purchase-only, fixed-rate mortgages that received loss mitigation between 2008 and 2012. The data was filtered to this population to facilitate the calculation of the payment reduction provided by loss mitigation and to a period when modifications were used as a loss prevention tool during the foreclosure crisis. The result was 99,551 unique loans for the study.

Borrower redefault was measured as whether or not a loan had six or more cumulative missed payments following the loss mitigation activity. Loan performance was observed up to 2020 to avoid cross-contamination with pandemic-related effects and policy. Loss mitigation could include a combination of interest rate changes, term changes and payment deferrals.

Greater payment reduction = lower redefault risk

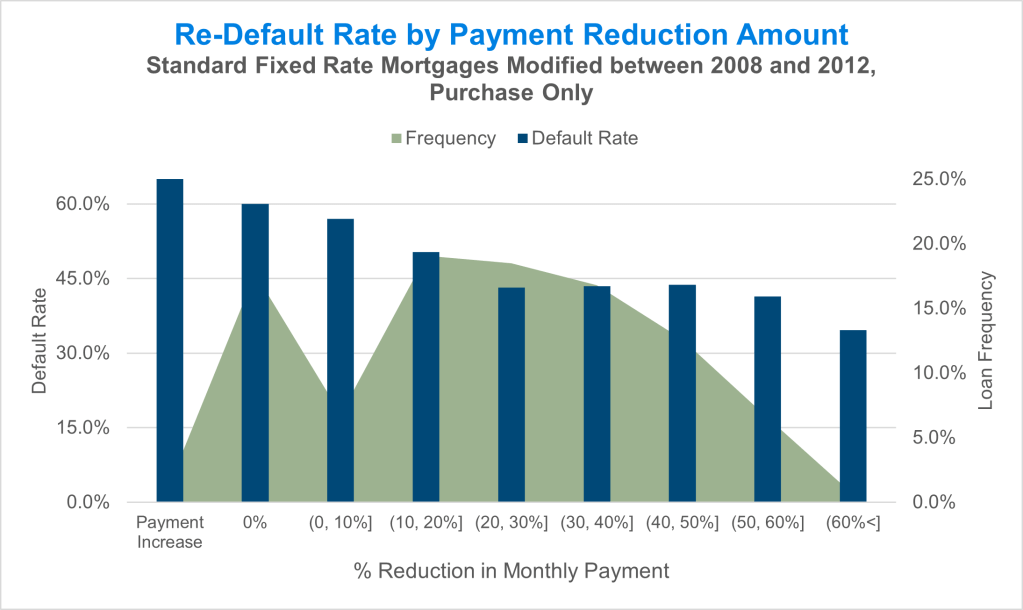

Most borrowers in the dataset received somewhere between a 10% and 30% payment reduction after loss mitigation. Borrower default rates generally decreased as the payment reduction amount increased. The redefault rate for borrowers that received a small payment reduction (i.e., greater than 0% and less than 10%) was 57%, and the redefault declined to 43% for borrowers that received a payment reduction between 20% and 30%. After a 30% payment reduction there is a diminishing return of additional payment reduction to borrowers. Borrowers who received no payment reduction or an increase had the highest redefault rates, at approximately 68%.

greater than 30% does not appear to have a significant additional benefit to redefault rates.

For the timing of redefaults, roughly 12% of redefaults for loans without a payment reduction or an increase in payment occur within the first two quarters following modification. These borrowers redefault more quickly when compared to borrowers who receive a higher payment reduction.

Impact of credit score on mortgage redefaults

We reviewed the data by credit score to evaluate if borrower credit score influenced either the amount of payment reduction offered or redefault rates. We found some notable differences when analyzing the data by credit score. First, the data shows that borrowers with lower credit scores, on average, were more likely to receive a lower average payment reduction when compared to borrowers with higher credit scores. In addition, borrowers with low credit scores were also more likely to receive a payment increase or no payment reduction.

When looking at borrower redefault rates, borrowers with lower credit scores have higher redefault rates when compared to borrowers with higher credit scores, after controlling for the size of the payment reduction. Furthermore, borrowers of the lowest credit score quartiles see a lower return to each incremental payment reduction amount, suggesting they need a greater amount of assistance to reduce their default probability to the same rate as borrowers with a higher credit score. Borrowers with higher credit scores benefit more as the payment reduction increases, but the redefault rate benefit is limited after a 30% decrease in monthly payment.

A regression analysis was performed to evaluate the above results while controlling for various other effects including income, risk attributes and economic conditions. The regression analysis confirmed the above results after controlling for other effects.

Key takeaways for mortgage bankers trying to prevent redefault:

In today’s market of 7%-8% mortgage rates, the typical strategy of loan modification – interest rate resets and term amortization – may not be the right solution to prevent borrower foreclosure, as these would likely result in payment increases for borrowers with low interest rates. As a result, payment reductions in this environment will likely be smaller than in years previous. More aggressive deferral or term extension policies may be necessary to maintain the same level of performance and to avoid higher redefault rates. In light of this, Freddie Mac recently announced an expansion to its loss-mitigation guidelines to help more delinquent borrowers.

There is evidence that under a controlled setting, higher levels of payment reduction do reduce borrower redefault, where on average the returns of additional reduction appear to diminish around 30%. Given that loan modification costs are a consideration limiting the amount of payment reduction that can be provided, the mortgage industry’s best loss mitigation strategy is to continue to focus attention on strong underwriting quality and originating long-term affordable mortgages for new homeowners. In the event of financial hardship, this research demonstrates the most effective forms of loss mitigation are those that provide a payment reduction to a borrower’s monthly payment.

The full research paper, “Assessing the Effectiveness of Payment Reduction on Preventing Borrower Re-Default for Mortgages,” is available on Milliman’s website.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to NewsLink Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)