Fitch Ratings: U.S. Non-Bank Mortgage Capital ‘Resilient to Earnings Pressures’ in 2024

(Chart courtesy of Fitch Ratings, New York.)

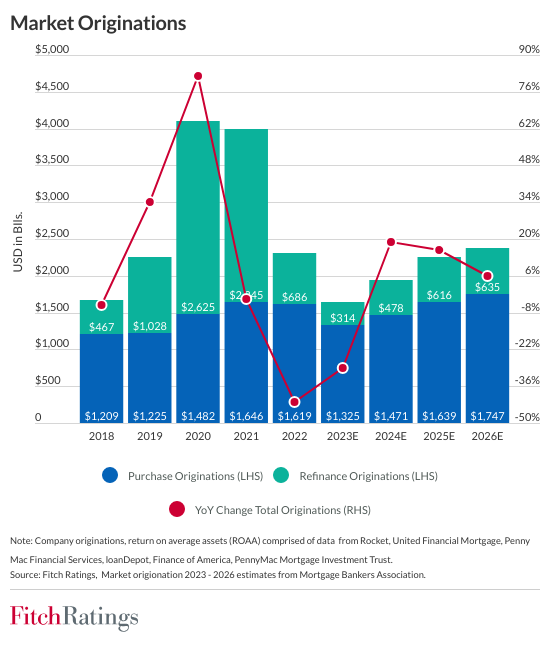

Fitch Ratings, New York, said it expects headwinds to continue to pressure revenue and earnings of non-bank mortgage companies next year, as origination volumes remain challenged given the higher-for-longer rate environment and industry overcapacity.

“However, financial performance is expected to stay within ratings sensitivities, amid meaningful cost reductions and reduced warehouse borrowing,” Fitch said in a non-ratings commentary, U.S. Non-Bank Mortgage Capital Resilient to Earnings Pressures in 2024.

“Fitch has a moderately deteriorating sector outlook for non-bank mortgage companies for 2024, given expectations for higher-for-longer rates and the challenging macroeconomic and geopolitical environment,” the report said. “While we expect rates to decline before year-end 2024, it will not to drive significant refinance volume, as refi opportunities on the majority of existing mortgages will remain firmly out of the money.”

Fitch said rated non-bank mortgage companies should see “modest improvement in operating results” in 2024 from reduced expense bases, as retail-focused firms in particular have significantly cut capacity and related overhead since 2022. “Earnings will remain pressured, but, along with origination volume, have likely already reached trough levels,” the report said.

“While 2022-2023 earnings were weak, origination declines and reductions in gain-on-sale margins were partially offset by valuation write-ups of mortgage servicing rights, supporting capital levels,” the report said. “Many issuers have servicing and origination segments which act as natural hedges against interest rate volatility, as lower prepayment assumptions increase MSR mark-to-markets.”