ATTOM Finds Profit Margins, Homeownership Tenure, Cash Sales Up

(Image courtesy of ATTOM)

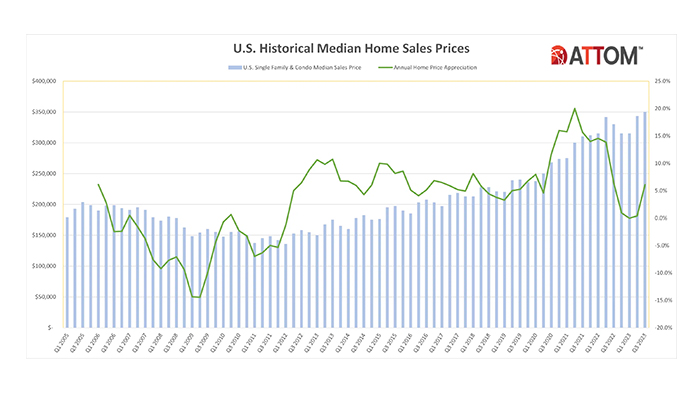

ATTOM, Irvine, Calif., released its third-quarter 2023 U.S. Home Sales Report, showing profit margins on median-priced homes are up from the second quarter, along with other metrics such as homeownership tenure and cash sales.

The profit margins on median-priced single-family homes and condos hit 59% in the quarter–up from 56.6% in the second quarter. That metric is being pushed up by a continued increase in home prices.

Median single-family home and condo prices are up from the second to third quarter of 2023, to a new high of $350,000. That’s up 2% over the previous record of $343,000 in Q2.

“Prices and profits around the U.S. got another boost over the summer as the housing market continued recovering from last year’s setbacks,” said Rob Barber, Chief Executive Officer for ATTOM. “Things do remain uncertain heading into the market’s annual fall slowdown, especially at a time when mortgage rates are rising again, home affordability is getting tougher and the potential for a recession hangs in the air. But the latest gains fell in line with what we often see during the third quarter and showed that any predictions of an extended market fallback may have been premature.”

Also from the report: Homeownership tenure is nearing a high point for recent decades. Homeowners who sold during the most recent quarter had owned their homes for an average of 7.86 years, the highest level since 2000.

That number was 7.6 years in the second quarter of 2023 and 7.2 years in 2022’s third quarter.

In other positive news, lender-owned foreclosure sales remain very low, at just 1.4% of single-family home and condo sales in the third quarter of 2023. In comparison, lender-owned foreclosures made up about 30% of sales in early 2009.

Institutional investors accounted for 5.9% of all sales, down from 6.2% in the second quarter of 2023 and 7.6% in the third quarter of 2022.

Federal Housing Administration loans were 8.8% of all single-family home purchases in the third quarter, down from 9.3% in Q2 2023 and up from 8% in the 2022 third quarter.

Cash sales are up, accounting for 36.6% of single-family home and condo sales, up from 36.4% in the second quarter and 35.2% in Q3 2022.

“The level of cash sales has inched up over the past year as mortgage rates in the U.S. have continued their march higher, now close to an average of 8% for a 30-year loan,” Barber said. “If rates keep rising, that should continue creating favorable conditions for more all-cash deals.”