A “Fool’s Gambit”—Surviving until 2025? A Mark Dangelo Editorial

Investors know that to base future strategy on historical performance is a “fools’ game.” Industry challenges cannot be turned successful by “shrinking operations”, “waiting for health”, “being simpler”, or even clawing back contractual signing bonuses. To survive and prosper “until 2025” requires a complete redesign of processes, personnel, and most importantly data.

“Doing more with less” has been a slogan for industries and consumers for decades. Today, the lending industries once again are reverberating from harsh realities—volume declines squeeze margins (pushing under 50 basis points per loan), reduction in industry employment (> 20% decline since 2020), and an acceleration in the demand to streamline operations.

Not since the Great Recession have banking, financial services and insurance (BFSI) and independent mortgage bank (IMB) industry leaders been forced to holistically reformulate their operations given the peak-to-trough volume decline of nearly 70% over the last three years. However, this transformational outcome will not resemble previous models. We only need to glance at the MBA Charts of the Week and Quarterly Performance Reports to understand the unprecedented industry challenges. From nearly every indicator, this historical decline and anticipated future recovery is not traditional.

What will be different? What will be the lingering impacts on operations? Will volume normalization just mean smaller operations? And what will the rise of Millennial and Gen-Z homebuyers demand when it comes to engagement? These and dozens of additional questions, each more pointed, will demand answers that permanently alter the lending landscape moving into 2024. The heralded designs and technologies of the past are now the foundational building blocks of the future.

To anticipate the “next gen” markets, the traditional approach to consumers and markets coupled with compartmentalized usage of FinTech will lead to further commoditization of products and services. Digitalization of processes will be abandoned for native digital solutions as the isolation and reuse of data will dominate as innovative, competitive differentiators.

Anticipating the “Next-Gen” Markets

For some leaders within BFSI, their corporate strategy for 2024 is to become a “simpler, smaller company.” Facing a confluence of interconnected factors—23-year high rates, continual home price increases, stubborn inflation, a “hot” domestic economy and record low housing inventories—lenders are experiencing a perfect storm of market conditions against traditional business practices. Moreover, margins continue to shrink, profits have fallen by double-digit percentages, and the mortgage industry finds itself designed for vastly different consumers, markets and operations all within an 18-month span.

To understand more than the chaos of today, BFSI and mortgage leaders must determine and navigate financial conditions that they never anticipated during the last 14 years. The time and money spent on securing systems and technologies were focused on volumes, and the need for efficiencies on a per loan basis was aided by the ubiquity and capabilities of cloud computing, SaaS, and widespread data replication.

Since 2010 with rapid rises of mobile innovations, technology became increasingly off-the-shelf allowing small and medium organizations to compete with larger adversaries. As a result, the reimagining of the industry, how data was sourced, the due diligence of the underlying data supply chains, were marginalized in favor of process-defined applications (i.e., time was more important than reuse). During the last seven years, vendors and outsourcers have consolidated resulting in fewer distinct solutions with control of the software market favoring the dominant players within the M&A event.

Now with the markets contracting, IMB’s have also undergone consolidation as traditional BFSI’s continue to scale back or exit the mortgage markets—shedding operations, portfolios, and personnel in the process.

With loan markets dominated for the last decade by the GSE’s, the demand for innovation, for streamlined processes, for data reuse has restricted data-ideation due to government oversight and regulatory compliance. But with political change already underway and investors finally realizing that the decade-long stranglehold held by GSE’s has outlived its initial rationale, the redesign of the lending industry is underway. As an example, look at the number of investments in non-GSE secondary loan software solutions.

The above represents the pressures on a lending industry and ecosystem that was at the peak of volumes back in 2021. Back in 2009-2011, many industry leaders and operators passionately believed that the 2005-2007 peaks would return “with a little time.” In 2023, unmoored expectations of a resurgence stoked traditional downturn adjustments—staffing cuts, marketing messages, mergers & acquisitions—but the likely reality moving forward is that the “next-gen” industry iteration will be natively digital, focused on data-as-a-product, and delivered using business orchestration.

Finally, if we subscribe to the benefits and designs of ethical, sustainable AI / ML, these are comprehensively data-driven systems, with data-defined building blocks, and all able to be transparently audited. If we trust our AI’s—can we trust the data they use in a highly regulated environment?

Adjusting the Current Transformations to the Future

The lending and BFSI markets were always about attracting the attention of financial consumers and locking them into the organization—that is, making it difficult for them to leave. Yet the next-gen consumers are natively digital, and they are less loyal, more inclined to change institutions, and less worried about traditional banking products and services. BFSI and lending solutions were designed around process, industry traditions, and the digitization of legacy models of operation. As examples, the meteoric rise of neobanks, virtual banks, P2P solutions all shatter the norms of traditional banking.

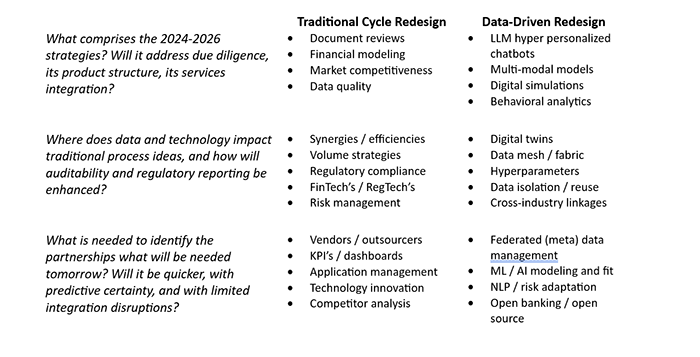

In tomorrow’s lending markets, consumers are adept at shopping rates, seeking favorable terms, focusing on rapid closing, reduction of “garbage” fees, and often having many institutions for financial products and services. The first step to reformulating BFSI and lending solutions to meet the next-gen requirements is to differentiate the traditional versus the data-driven, orchestrated designs required for tomorrow’s operating demands.

What the comparison illustrates is a clear delineation of design and ideation between volume business models. Gone are the siloed FinTech characteristics. They are incorporated into a larger, more reusable data “mesh” design concentrated around the domain entities and attributes. The solutions once sought after for large, serial processing constructs are replaced by reusable, data isolation modules (DIMs) that ensure data consistency, demand, quality, and encapsulate rules of use.

With the data isolated and reusable across once siloed systems, the information captured during customer contact, that was manipulated during origination, that was shared as part of portfolio management or securitizations, and that was provided to servicing platforms is part of a data supply chain. The chain is immutable, it is auditable, and it reduces the downside of reps and warrants challenges when the markets turn negative (likely in 2024-2025 as unemployment rises).

However, is that all there is (i.e., moving from system ideation to data ideation)? How can our organization turn what must be done (e.g., strategy) into actionable tasks, budget items or even vendor commitments?

(Re) Defining Ideations: Digitized “Paper” to Native Digital

BFSI and lending suffer from a short-term memory issue. The BFSI software industry was created by landmark solutions from Hogan Systems, IBM FSDM designs, and SunGard. These system ideation approaches left lingering legacy designs that we augmented by secondary vendors who incrementally “improved” the original designs becoming our FinTech and RegTech vendors of the day.

However, all these ideas and systems never completely decoupled their ideations from their past—it was too large of a leap to move from requirements to what is possible. Therefore, these step improvements focused on the automation of paper-based processes and forms while creating databases, warehouses, and even cloud services for rapid provisioning. These all culminated into what today is a robust market filled with nearly 14,000 FinTech and RegTech vendors and dozens of large players some of which in the last five years bought many vertical mortgage solutions with the intent to comprehensively control the industry outcome from origination to securitization.

Today, IMB’s and integrated BFSI’s seeking to remake their mortgage business face a vendor market that has a few integrated software solutions, and many smaller solutions (e.g., LOS, servicing) that have unique features and functions. Software’s reality is often bleak, one-size fits all, and for many small players (which make up the lion share of market participants) too expensive to adopt. However, as the customer and outside partners (non-traditional industry participants) comprehensively move to native digital behaviors and value creation, the value of these domineering, integrated solutions becomes marginalized. Why?

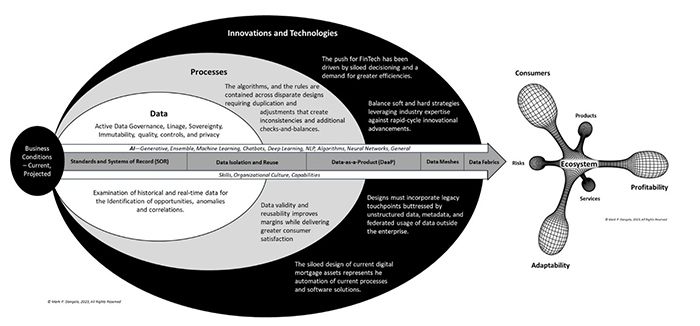

As the design of industry solutions moves to data rather than process (now secondary), those IMB’s and integrated BFSI’s unleash and leverage their IT organizations as orchestrators of solutions. In the hands of skilled teams using agile or hybrid deployments, they “assemble” stacks of solutions all built upon a data foundation—much like a child does with Lego’s. We all have available to us these “same” building blocks, but how we assemble them, the timings brought to the markets, the customer segments served all mean that it is about how we connect or “glue” these functionally rich capabilities together that makes the real competitive advantage. The illustrative figure below represents an image of why starting with data is the profitable design for future operations.

While the image is a representation of an implied macro architecture, the implications of implementation become apparent. By decoupling the data from the systems, auditable back into the SOR’s, we provide a comprehensive and transparent path for all high expectation technologies currently in their embryonic lifecycles (e.g., LLM’s, AI, ML, NLP, et al). By having the data ideation transcend software, innovations, and technologies, smaller players can protect the one asset they must control—their data and its value to the complete loan and BFSI (data) supply chain.

The implementation of this approach is simple, yet it must be accomplished in steps. First, the foundational design must be concentrated on the data domains and isolation modules. The requirements include upstream and downstream connectivity and sharing, partnerships and third-party solutions, virtualization and auditability, and the rules of operation, which enforce immutability, lineage, and the layering of federated data sources.

With the foundation in place, sprints can be undertaken to migrate traditional practices to use the data. With the foundation in place, new correlations and AI to AI solutions can be implemented with transparency. Without the data architectural design implemented as a foundation to create process solutions, the fragmentation of systems that were dominated by volume design requirements will continue to raise per loan costs even after the organization sheds employees and claws back their signing bonuses.

In conclusion, BFSI and IMB leaders can try to wait it out for “better in 2025”, but that still is 15 months away. I for one, don’t have a crystal ball, and I have little faith in our politicians and regulators. I do have faith in the consumer, what they are digitally seeking, and how they want to be served not just from an ability to get a loan. While 35 years of a historical trend has cut the number of FDIC banks down to under 4,000 from the 12,500 of the mid-1980’s, we can also look at those IMBs and plot a similar trend.

The ability to survive this redefinition of the industry is to rapidly adapt to the digital ecosystems being used and monetize the data that really is the asset of the industry. This downturn is one of the greatest opportunities for small and medium sized lenders—but only if they use data ideation to lead.

Who will be standing in 2025 if they “follow the herd”, abide by the largest software marketing ideals, ignore the open banking platforms, and fail to recognize the shift already underway? The next 15 months may truly become a watershed event for one of the most important domestic industries. Indeed, waiting or believing in history as a representation of the future will likely prove to have been a “fool’s gambit.”