Redfin: Record Share of Home Sellers Drop Asking Prices

(Illustration courtesy of Redfin)

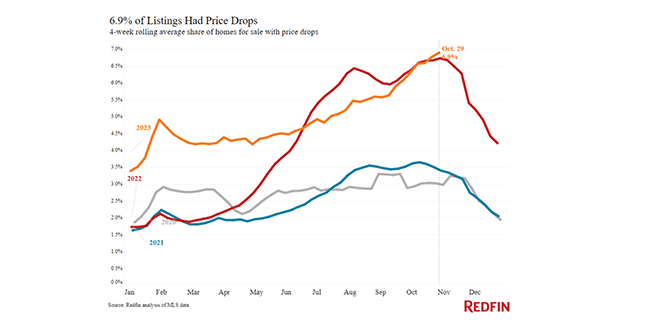

Nearly 7% of for-sale homes posted a price drop during the four weeks ending October 29, on average, the highest portion on record, according to Redfin, Seattle.

The record comes as mortgage rates hover at elevated levels, having recently reached their highest level in 23 years. High rates have forced some sellers to lower their asking price to make up for high interest rates on monthly payments, Redfin said.

Note: buyers got a bit of relief last week as daily average mortgage rates dipped from 8% down to 7.5%.

“Some sellers are pricing too high because they have fear of missing out after their neighbor’s house sold well over asking price two years ago,” said Seattle real estate agent Patrick Beringer. “While low inventory is driving some competition and relatively affordable homes in popular neighborhoods are still selling fast, they’re getting two or three offers as opposed to 20 offers at the height of the market. With mortgage rates in the 7.5% to 8% range, buyers simply don’t have the budget they would have had two years ago or even one year ago.”

Sale prices remain up 3% from a year ago. “That’s partly because sale-price data is a lagging indicator, reflecting deals that went under contract a month or two ago,” the report said. “Growth in sale prices may slow in the coming months as it starts to reflect sales that went under contract as mortgage rates hit 8% in October.”

Another reason for rising sale prices is that despite slow demand, low inventory levels are propping up prices. The total number of homes for sale is down 10% year over year.