Mortgage Lock Volume Drops, Mortgage Capital Trading Finds

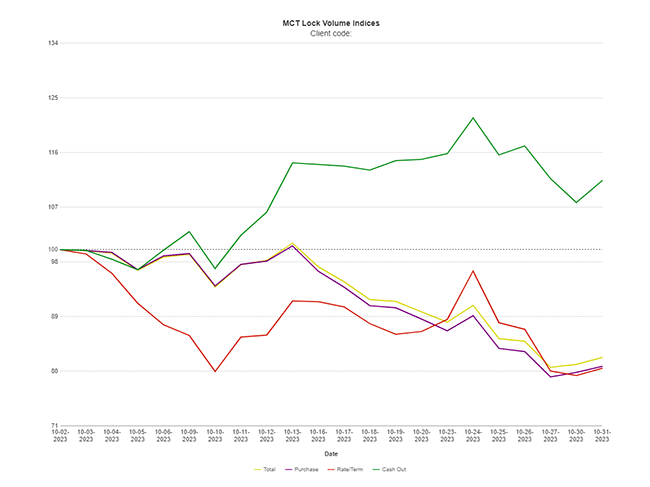

(Chart courtesy of Mortgage Capital Trading)

Mortgage lock volume dropped 17.7% in October compared to September, per Mortgage Capital Trading, San Diego.

“Loan originations for October continued to dip as mortgage rates hovered around 8% and lack of housing supply continues to slow origination volume,” MCT said in its monthly Lock Volume Indices report.

“Cash out refinances jumped more than 11% in October from the previous month,” said Andrew Rhodes, senior director and head of trading at MCT. “However, given that cash out refinances are already at notable lows, I don’t believe it to be statistically significant.”

MCT said this trend is expected to play out through 2023 as the Fed paused rates at its November meeting and indicated the potential for another rate hike before the end of the year. “Multiple factors such as an 8% mortgage rate, the Fed’s continued fight against inflation and the industry’s cyclical winter lull shows we’ll likely continue to see low origination volume heading into the new year,” Rhodes noted.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across diverse lenders from MCT’s national footprint.