Fannie Mae: Record-High 85% of Consumers Call it a Bad Time to Buy a Home; Most Expect Rental Prices to Increase

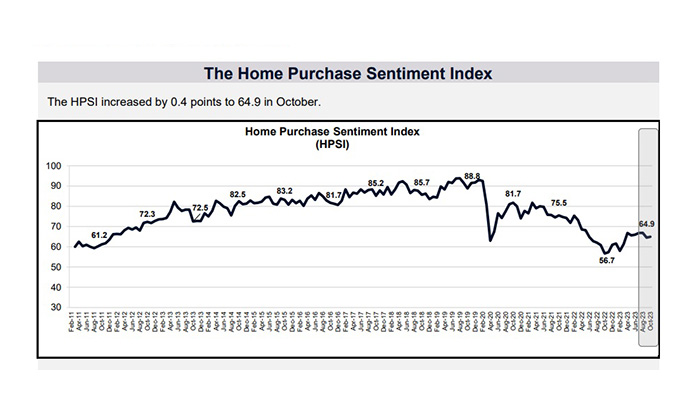

(Chart courtesy of Fannie Mae)

The Fannie Mae Home Purchase Sentiment Index remained largely flat in October, as consumer frustration toward housing unaffordability and an economy battling inflation continues to depress overall sentiment.

But a survey-record 85% of consumers called this a “bad time” to buy a home, with most respondents citing high home prices and high mortgage rates as the primary reasons. By comparison, only 37% believe it’s a bad time to sell a home.

Overall, the full index is up 8.2 points from its all-time low last year.

“Consumers expressed even greater pessimism toward the larger economy this month, in addition to their ongoing frustration with the housing market,” said Doug Duncan, Fannie Mae senior vice president and chief economist.

Duncan noted more than three out or four respondents called the economy “on the wrong track” – up from 71% last month. “They overwhelmingly cited inflation as the primary reason why,” he said. “Across all income groups, inflation has consistently driven the wrong track belief since the end of last year, suggesting consumers are fed up with the high prices of many goods and services.”

Many consumers believe their purchasing power has not kept up with prices, as 69% of consumers said their incomes are about the same compared to the previous year. “We expect this tightness in household finances, along with high home prices and elevated mortgage rates, to prolong the affordability challenges facing many would-be homebuyers,” Duncan said.

Fannie Mae also asked about rental housing. Respondents said they expect rental prices to increase 7.0% on average over the next 12 months, a figure unchanged from last month’s survey. The share of consumers who expect home rental prices to go up stayed at 68%, and the share who expect rental prices to go down decreased 1 percentage point to 6%.