Urban Land Institute, PwC Report: New Norms Emerging in Industry

(Image via ULI and PwC)

The Urban Land Institute, Washington, D.C., and PwC, London, released their annual Emerging Trends in Real Estate 2024 report, highlighting the “Great Reset” present in the industry.

“It’s clear that the real estate industry is entering a new era of thinking, building and operating. The emergence of hybrid work models, the strength of the retail sector, and the growth of Sun Belt markets underscore the new reality on the ground, specifically in our top cities–Nashville, Phoenix, Dallas/Fort Worth, Atlanta and Austin–to watch in 2024,” said Anita Kramer, Senior Vice President of ULI’s Center for Real Estate Economics and Capital Markets.

“Overall, our data this year shows slightly lower ratings across U.S. markets in terms of development and investment prospects, reflecting a certain degree of caution at the start of the new era. And ratings among top cities are tighter, indicating a sense that there is less difference among market prospects than has been the case. Now, industry professionals are at a turnkey moment that will require both innovation and adaption to shape a resilient real estate landscape for the future,” Kramer continued.

The report identified a number of key trends for those keeping an eye on the market, including that “higher and slower for longer” for rates seems likely, so real estate professionals will need to navigate that reality.

The commercial real estate market will see a “great reset,” the report noted, but the diverse nature of the industry still provides opportunities in select segments. There will be opportunities for private lenders in the CRE market as the debt environment remains challenging.

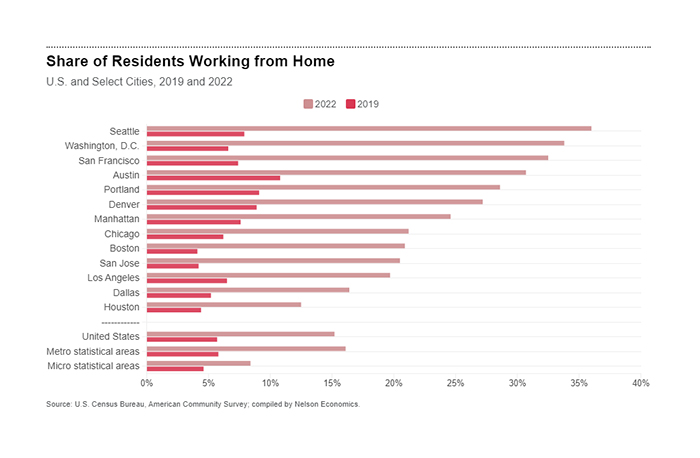

The report also points to the fact that it’s very unlikely the work landscape will return to pre-pandemic norms, with remote work here to stay and downtowns needing to be revitalized with investments such as housing or “third places.”

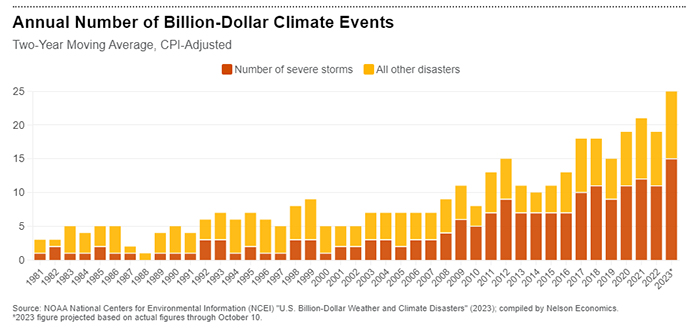

Climate change is having a strong impact, including rising insurance costs and an increasing focus on Environmental, Social and Governance initiatives. Housing affordability also remains top of mind, and the housing supply needs to be increased while addressing regulatory issues and construction costs.

In general, portfolio managers in the commercial real estate space have a lot of factors to consider, including diversification, ESG and alternative property types to replace traditional pillars like offices and retail, among others.

Finally, the emergence of consumer AI programs in the real estate industry may both affect personnel and require innovative office spaces in tech hubs.

“Despite economic headwinds and challenges with obtaining credit, there are opportunities available for high-quality properties that meet the needs of investors and tenants,” said Andrew Alperstein, a leader with PwC’s U.S. real estate practice. “Firms must learn to ride out the current short-term risks and adapt their growth strategy to succeed in this period of higher-for-longer interest rates.”

The report also included a list of markets to watch; this year’s list is heavily focused on the Sun Belt, with Nashville, Tenn., first. In the rest of the top 10 are Phoenix; Dallas/Fort Worth, Texas; Atlanta; Austin, Texas; San Diego, Calif.; Boston; San Antonio, Texas; Raleigh/Durham, N.C.; and Seattle.