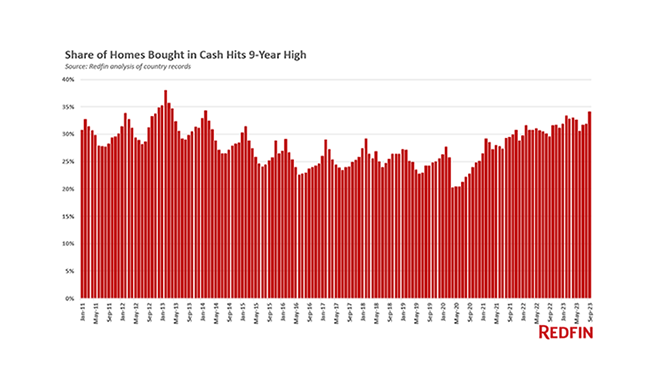

Redfin: 1 in 3 Homebuyers Paying All Cash, Highest Share in Nearly a Decade

(Chart courtesy of Redfin)

Redfin, Seattle, reported the share of homes bought in all cash hit its highest level since 2014 in September as elevated mortgage rates made paying in cash more attractive.

Just over one-third (34.1%) of U.S. home purchases in September were made in cash, up from 29.5% a year earlier and the highest share in nearly a decade, Redfin said.

The report said all-cash purchases make up a bigger piece of the homebuying pie for two major reasons: affluent Americans who can afford to pay cash are more apt to buy homes in such an expensive housing market, when the income necessary to buy a home is higher than ever before, and elevated mortgage rates make buying a home in cash to avoid interest altogether more attractive.

The weekly average 30-year fixed mortgage rate hit 7.2% in September, its highest level in two decades. They moved even higher in October, nearing 8% and pushing monthly mortgage payments up about 20% from a year ago to record highs. Rates have since come down a bit from their October highs, but they remain more than double early-pandemic levels.

Rising rates are deterring homebuyers who take out mortgages more than they’re deterring all-cash buyers, the report said: Overall home sales are down 23% year-over-year in the metros Redfin analyzed, compared with an 11% decline for all-cash sales.

The report also noted that high rates can also be a deterrent for buyers who can afford to pay in cash, because they could get better returns on their money by investing it somewhere besides the housing market, especially when home prices are high and there’s potential for them to come down.

“High mortgage rates are exacerbating inequality between people who own homes and people who don’t,” Redfin Senior Economist Sheharyar Bokhari said. “Home prices are roughly 40% higher now than before the pandemic homebuying boom, and soaring mortgage rates have made the divide even bigger by adding more to monthly payments. Affluent Americans are the only ones who can avoid the sting of high mortgage rates; plus, they’re spending less on housing and keeping more money in the bank because they’re avoiding interest payments. Meanwhile, those who are sidelined by high prices and rates not only can’t afford a home now, but they’re not building wealth through homeownership for the future.”

The last time all-cash purchases were this common was in 2014. At that time, affluent buyers and corporate investors who could afford to pay cash were leading the housing market recovery from the subprime mortgage crisis, while would-be first-time homebuyers were still suffering the effects of the Great Recession.