CBRE: Hotel Revenue Growth Predicted for 2024 Despite Slower Q3

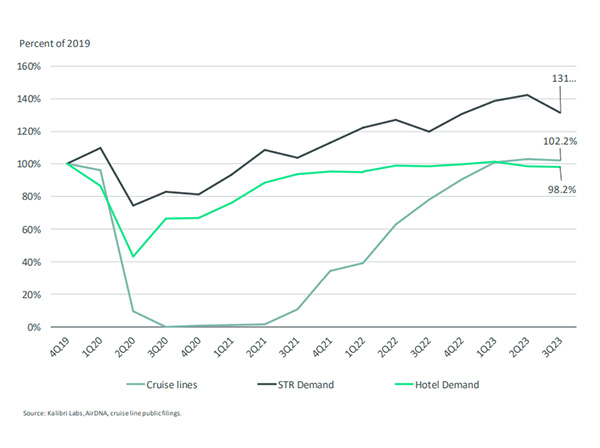

(Cruise line, short-term rental and hotel demand vs. 2019, via CBRE report)

CBRE, Dallas, is forecasting a recovery in revenue per available room growth for hotels in 2024.

CBRE anticipates a 3% RevPAR growth in 2024, with a 40-basis-point occupancy improvement and an increase of 2.3% in average daily rates. That RevPAR would also be 14% above pre-pandemic 2019 levels.

The forecast acknowledges hotel RevPar is strongly affected by the state of economy, so shifts there could have a notable impact.

However, in Q3 of this year, CBRE also reported that RevPar did decline slightly–by 0.3%. That was the first quarterly decline since the post-pandemic recovery cycle began.

ADR growth was the slowest so far in that post-pandemic time period, at 0.6%. Occupancy dropped by 1%.

The best performing type of lodging in the quarter was urban, where occupancy was up 110 basis points. Occupancy rates for all location types were below 2019 rates, but town locations were the closest to their 2019 levels at 97%.

“U.S. hotel operators faced stiff headwinds to demand and pricing power over the summer due to the number of Americans who elected to vacation overseas, go on cruises or stay in short-term rentals or other alternative forms of lodging,” said Rachael Rothman, CBRE’s Head of Hotel Research & Data Analytics. “We expect RevPAR trends to improve modestly as we head into 2024, as these headwinds ease and the number of inbound international travelers further recovers.”

In the third quarter, hotel wages grew 4.7%, above the national average of 4.3%, but down from 7% at the end of last year. Average hourly wages in the hotel space remain about $10 below average, so CBRE anticipates pressure for wage increases will persist.