October Housing Starts Exceed Expectations

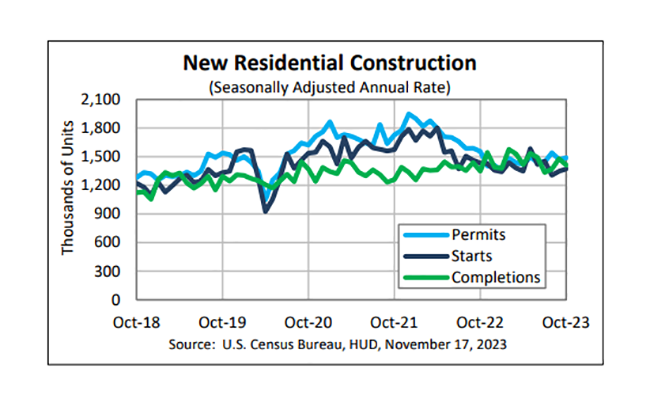

(Chart courtesy of Census Bureau; HUD)

Housing starts rose in October to a seasonally adjusted annual rate of 1.37 million, exceeding the consensus expectation of 1.35 million.

The Census Bureau and HUD jointly announced residential construction statistics for October on Friday.

The figure is 1.9% above the September estimate of 1.34 million but 4.2 percent below the October 2022 rate of 1.43 million.

“While higher mortgage rates have dampened homebuilder sentiment since August, single-family housing starts have remained resilient,” said Odeta Kushi, Deputy Chief Economist with First American. “Builders have been benefitting from the lack of resale inventory and from their ability to use incentives such as mortgage rate buydowns to entice buyers off the sidelines.”

Kushi called incentives such as mortgage rate buydowns a “huge competitive advantage” builders have over the resale market. “The housing market remains underbuilt relative to demand, and if you can’t find an existing home to buy, a new home at the right price is a good alternative,” she said.

The Mortgage Bankers Association’s Builder Application Survey data for October 2023 shows mortgage applications for new home purchases increased 39.7% compared to a year ago. Compared to September 2023, applications increased by 6%. This change does not include any adjustment for typical seasonal patterns.

“Purchase activity for newly constructed homes continued its upward climb in October with purchase applications up 40% compared to a year ago, the ninth consecutive month of annual growth,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Home builders have been able to temper this high-rate environment by offering buyers rate buydowns and other incentives. We estimate that the pace of home sales increased for the third straight month to a 715,000-unit annual pace – the strongest sales month since May 2023.”

Single-family permits, a leading indicator future homebuilding activity, rose 1.1% from September to a seasonally adjusted annual rate of 1.48 million, HUD and Census reported. The figure is 4.4% below the October 2022 rate of 1.55 million.