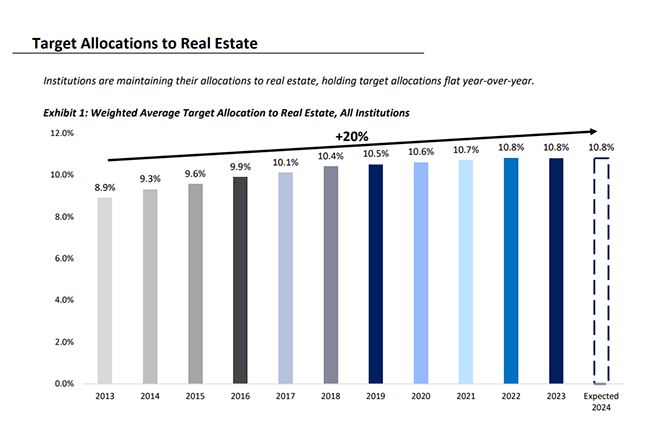

Institutional Target Allocations to Real Estate Remain Flat for the First Time Since 2013

(Illustration courtesy of Hodes Weill & Associates and Cornell University’s Baker Program in Real Estate)

Institutional target allocations to real estate are flat for the first time in 10 years at 10.8%, finds the 11th annual Institutional Real Estate Allocations Monitor, published by Hodes Weill & Associates and Cornell University’s Baker Program in Real Estate.

“Institutions have chosen to spend 2023 focused on managing their existing portfolios in an environment in which investors are waiting for valuations to find a bottom,” the report said. “While the survey finds that institutions expect to hold target allocations steady in 2024, investors believe the next few years will prove to be good vintage years to capitalize on expected dislocation and distress.”

Douglas Weill, Managing Partner at Hodes Weill & Associates, noted that while target allocations are flat year-over-year, this follows ten years of increases totaling 190 basis points, which represents an increase of over 20%. “Moreover, the industry has consistently outperformed relative to target returns over the long-term,” he said. “Despite short- to medium-term macroeconomic disruption, investor conviction in the asset class remains near its high, and the asset class continues to play an important role in institutional portfolios alongside other alternative allocations including private equity, private credit and venture capital.”

Weill said from a macro perspective, the looming wall of debt maturities may be the catalyst for valuations to find a bottom, “encouraging investors to return from the sidelines.”

The majority of institutions are at or over target allocations to real estate, with nearly 40% of survey respondents reporting overallocation to the asset class by 200 basis points on average, compared to 32% of institutions in 2022 by an equal margin. “However, while the denominator effect has been in play since early 2022, there are signs it is beginning to abate, bringing portfolios back into balance,” the report said. “This can be attributed to a rebound in public equities from a low in September 2022 combined with write-downs of private real estate portfolios.”

The survey’s “Conviction Index,” which measures institutions’ view of real estate as an investment opportunity from a risk-return standpoint, increased from 6.0 to 6.4 – its second-highest level since the survey launched in 2013. The report attributed the rebound in sentiment to increasing optimism that compelling buying opportunities will emerge as valuations find a bottom.

“To that end, investors are starting to deploy capital to select opportunities after an extended period on the sidelines, though they remain cautious, citing concerns relating to further devaluations as interest rates remain higher for longer, and uncertainty regarding macroeconomic fundamentals, including the potential for a recession,” Hodes Weill and Cornell said.