Down Payment Resource: Housing Authorities Roll Out New Homebuyer Assistance Programs

(Illustration courtesy of Down Payment Resource)

Homebuyer assistance program administrators are responding to the mounting home affordability crisis by rapidly rolling out new homebuyer assistance programs and funding buydowns, according to Down Payment Resource, Atlanta.

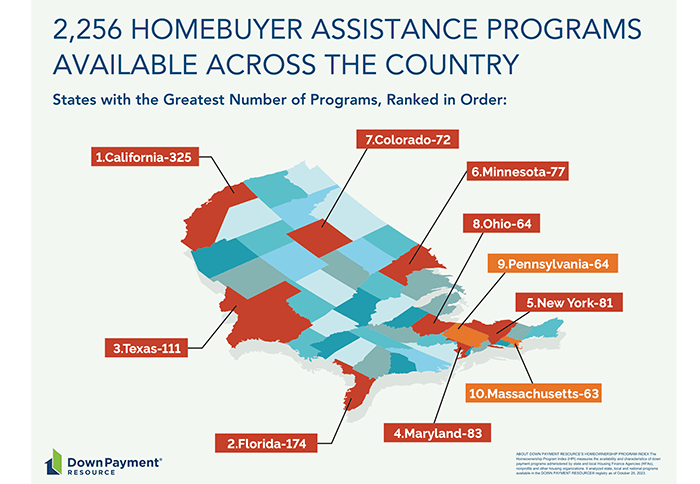

There are now 2,256 homebuyer assistance programs available to help people affordably finance homes, an increase of 54 programs over the previous quarter, DPR’s third-quarter Homeownership Program Index report found.

“Most first-time homebuyers are well aware that interest rates are hitting generational highs and affordability is in the gutter — but what they are not hearing is that there are 2,256 homebuyer assistance programs available to help,” Down Payment Resource Founder and CEO Rob Chrane said.

Chrane noted many programs now allow funds to be used for buydowns and other financing strategies that can take the edge off monthly mortgage payments.

Key Findings:

An examination of the 2,256 homebuyer assistance programs that were active as of October 25, 2023, resulted in the following key findings:

295 programs will fund buydowns. Buydowns allow borrowers to lower their interest rates by paying an upfront fee. They have become a popular financing strategy as interest rates have surged.

253 programs will fund permanent buydowns. Permanent buydowns allow borrowers to lower the interest rate over the life of the mortgage loan by paying an upfront fee. 11.2% of programs support these buydowns.

66 programs will fund temporary buydowns. Temporary buydowns allow borrowers to lower their interest rates for a defined number of years at the beginning of the loan by paying an upfront fee.

224 programs will fund certain upfront loan fees. 9.9% of programs allow funds to be used to pay the upfront mortgage insurance premium on FHA loans, the funding fee on VA loans and the guarantee fees on USDA loans.

71 programs will fund mortgage insurance buydowns. These programs allow funds to be used to lower monthly MI premiums.

50 new agencies began offering programs. More agencies have stepped up to administer homebuyer assistance programs as affordability worsens. Now, a total of 1,373 agencies provide assistance to aspiring homeowners, a 3.7% increase over the previous quarter. For a complete list of homebuyer assistance programs by state, visit https://downpaymentresource.com/wp-content/uploads/2023/11/HPI-state-by-state-data.Q32023.pdf.