MBA Chart of the Week May 30, 2023: Affordability Continues to Erode

MBA recently released its April Purchase Applications Payment Index (PAPI), which revealed that affordability continued to erode in the first four months of 2023.

PAPI, which measures how new purchase mortgage payments vary across time relative to income, increased 29.2% between December 2021 and December 2022 as 30-year fixed-rate mortgage rates doubled. However, despite interest rates leveling out between December 2022 and April 2023, the index continued to grow as median application amounts increased from $300,000 to $330,000. April’s reading of 172.3 for the national index (red line on chart) was a new record-high for the series.

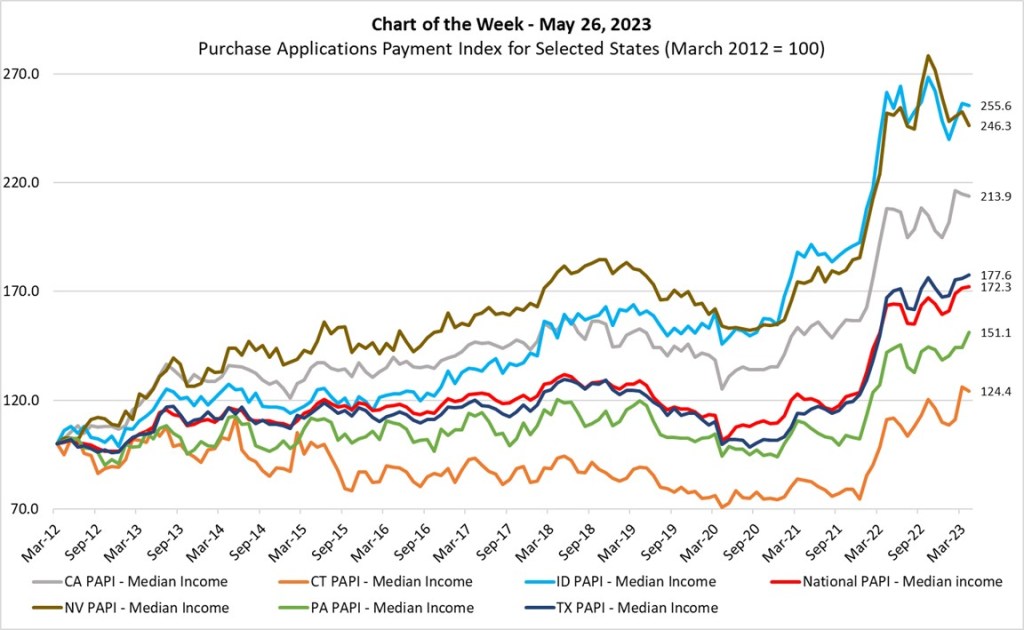

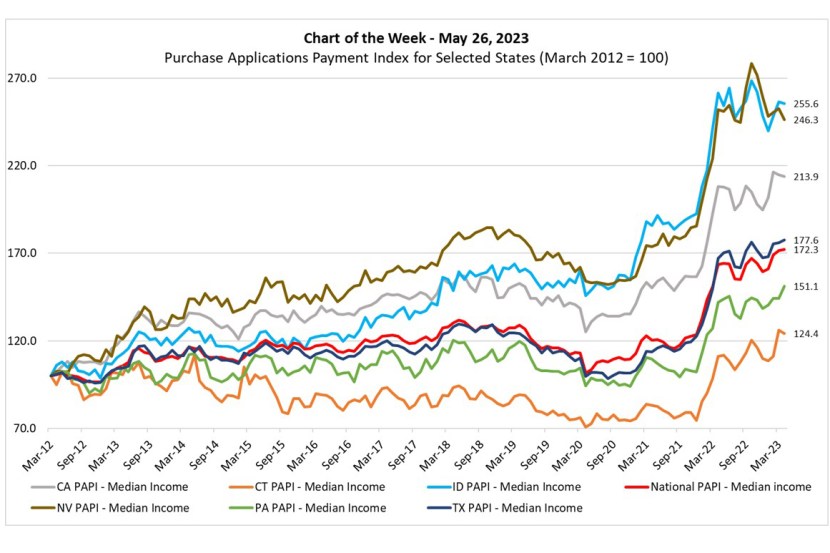

In this week’s Chart of the Week, we show the PAPI series – constructed using median Weekly Applications Survey (WAS) payments and median income – for the nation and six selected states. The two states with the highest PAPI in the nation were Idaho and Nevada. Both states had lower PAPI readings in April (255.6 and 246.3, respectively) than they had in April 2022. These decreases were driven by the median purchase application amounts falling 9.3% in both states over the 12-month period. Indeed, the PAPI readings for both Idaho and Nevada have moderated since their highs in October 2022. On the other hand, the PAPI series hit new records in Texas and Pennsylvania in April. California and Connecticut came off series highs in March with slight moderation in April. The national median Weekly Applications Survey (WAS) payment for 30-year fixed-rate mortgage purchase loans (that underlies PAPI) also hit a record in April at $2,112. To understand how this may evolve going forward we take MBA’s forecasts for the 30-year fixed-rate and the median price of existing homes and assume that the median downpayment percentage will remain constant. In this case, we predict that the median payment for new home purchases will decrease to $2,008 in December 2023 and to $1,880 in December 2024.