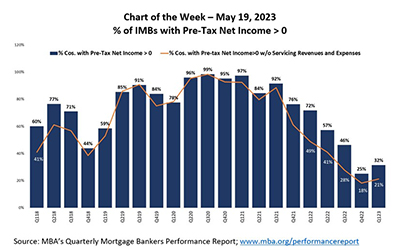

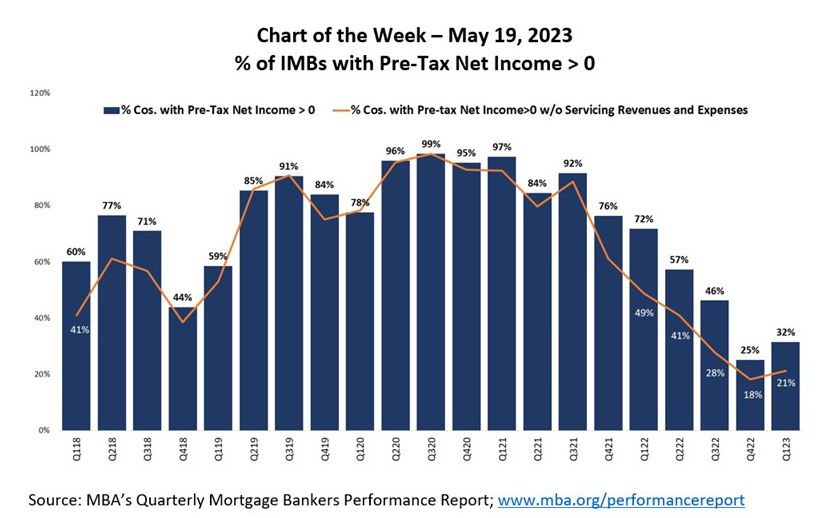

MBA Chart of the Week May 19, 2023: % of IMBs with Pre-Tax Net Income

On Thursday, MBA released first quarter results of its Quarterly Mortgage Bankers Performance Report. The first quarter marks the fourth consecutive quarter of net production losses for the independent mortgage bankers included in this report.

After reaching a study-low in fourth quarter 2022, pre-tax net production losses improved in the first quarter, despite continued declines in volume and increases in production expenses.

Today’s Chart of the Week compares the percentage of companies in the QPR that reported positive pre-tax net income including all lines of business (e.g. production and servicing operations), versus the percentage of companies that reported positive pre-tax net income, once servicing operations are excluded.

In the first quarter, 32 percent of the 312 independent mortgage bankers and mortgage subsidiaries of chartered banks posted overall positive pre-tax net income, an improvement from the 25 percent of companies reported for the fourth quarter. Once any ongoing revenues and expenses associated with holding mortgage servicing rights are excluded, the percentage of companies reporting pre-tax net financial profits falls to 21 percent in first quarter, after being at 18 percent in the fourth quarter.

Conditions continue to be challenging for the industry, with the upside of holding mortgage servicing rights most apparent in the first half of 2022, when there was a larger variance between the percentage of companies earning an overall profit including all business lines versus excluding mortgage servicing operations.

Jenny Masoud jmasoud@mba.org; Marina Walsh, CMB mwalsh@mba.org.