Redfin: For Housing Price Growth Trends, Look Local

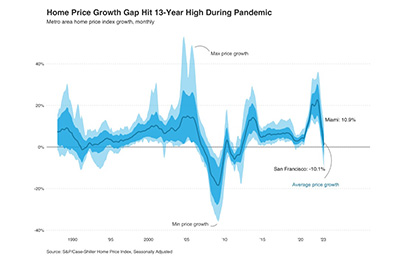

Redfin, Seattle, said home price growth trends in spring 2022 hit the highest metro-to-metro variation since the Great Recession.

Redfin reported price growth continues to fluctuate in different U.S. regions as some markets begin to cool and some remain hot, but noted the variation has come down since the 13-year high notched last spring.

In a release, Redfin highlights as an example the largest price growth gap right now — San Francisco and Miami. San Francisco home prices are down 10.1% year-over-year and Miami’s are up 10.9% year-over-year.

“The stark difference in home price dynamics between the Bay Area and Miami may be a reflection of a long-term, pandemic-fueled shift in where people choose to live,” said Redfin Deputy Chief Economist Taylor Marr. Redfin cited the increase in remote work, recent tech industry layoffs and the still-high prices in the Bay Area as potential contributing factors.

The top five largest growth gaps among major metros Redfin analyzed show a common theme, with Seattle and Miami; San Francisco and Tampa, Fla.; Seattle and Tampa, Fla.; and San Francisco and Atlanta.

Redfin analyzed Case-Shiller Home Price Index data from January 1988 through February 2023 for the report.

According to Redfin’s analysis, March to May 2022 specifically showed the highest metro-to-metro variation in price growth since 2009. “Home prices were rising everywhere during those months, but how much they were rising depended heavily on where you lived,” the release stated, noting prices increased within 15.2 percentage points of the national average (+21.2% year-over-year in April 2022) in most metros, anywhere from +13.6% year-over-year to +28.8%.

While those numbers have normalized somewhat since last spring–although still well above the pre-pandemic landscape–Redfin noted price growth tends to vary during times of economic uncertainty or upheaval.

“Extreme moments in history lead to extreme swings in home prices,” Marr said. “During economic boom times, when many Americans are flush with cash, homebuying demand soars because many people have the means to buy both primary and vacation homes and perhaps move from one part of the country to another. That pushes prices up in certain places and grabs the attention of home flippers, who jump into the ring and push prices up even further. When there’s a recession like there was in 2009, or economic uncertainty and fears of a recession like in 2023, homebuyers quickly pull back and prices swing down in some areas.”

Redfin notes this may provide a lesson for those seeking to buy: Focus on local trends over national.

“If you’re buying a home here in the D.C. area, don’t rely on real estate advice from your friend in the Midwest or your cousin in California,” said Washington, D.C., Redfin Premier Agent Steve Centrella. “Insights from other parts of the country can create confusion because they don’t necessarily reflect what’s happening on the ground in your neighborhood.”