Francesco Paola of Mozaiq.ai: How Intelligent Automation Helps Lenders Win

Francesco Paola is a business executive and technology entrepreneur with more than 25 years of global leadership experience in enabling enterprises to adopt innovative and transformational technology solutions at scale. He has spent his career delivering technology strategy and implementation services at the forefront of innovation, including deploying some of the first ecommerce solutions in financial services, developing innovative payment platforms, enabling adoption of outsourced technology and business services, helping enterprises adopt the transformational power of cloud computing and most recently enabling proliferation of intelligent automation solutions in the mortgage lending ecosystem.

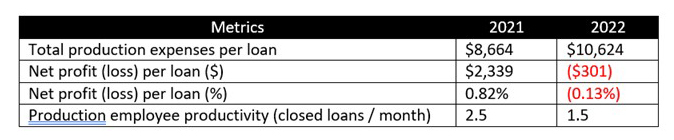

The Mortgage Bankers Association’s Annual Mortgage Bankers Performance Report for 2022 was released at the beginning of April, and the data, although not a surprise, was disconcerting.

As loan volumes precipitated, lenders could not adjust their capacity fast enough—the number of production employees did not decline at the same pace as origination volume declines, causing production expenses per loan to increase and already tight profit margins to evaporate and turn negative. No lender can afford to make a single mistake in this environment.

And mistakes are more prevalent with lenders that have not invested in technology and automation, having to rely on employees for complex and simple tasks, from underwriting a loan to locking a rate, instead of creating a hybrid environment where technology and automation can alleviate the load of the more repetitive, mundane tasks.

Add on new GSE (Fannie and Freddie) requirements and a challenging scenario unfolds: all lenders must now audit 10% of files at the Pre-Fund stage, instead of the current 5% of files; and Post Close Quality Control reviews will be required to be complete within 90 days instead of the current 120 days. (Inside Mortgage Finance reported that mortgage sellers repurchased $4.63 billion of single-family loans from Fannie and Freddie in 2022, a 55.5% increase over 2021.)

Now lenders are squeezed on both sides – the need to improve loan profitability and at the same time ensure that their loan quality meets the new compliance criteria. Make no mistake, these two are related—compliance directly impacts profitability (and the lender’s reputation).

Let me explain. Examples of common, critical deficits fall into two categories: credit and collateral. Credit defects could be missing or expired documents required by the GSE, documentation not supporting the borrower income or assets, and incorrect calculations. Collateral defects often involve a lender missing flags on the appraisal for soft markets and high CU1 scores. Poor loan quality can have severe adverse impacts on a lender:

- They may be forced to buy back the loan at significant costs to the lender

- They may not be able to sell certain loans to GSEs (Fannie and Freddie) and to aggregators

- They could lose their GSE tickets if quality is not maintained, where the threshold of critical defect rates must be consistently below 2% or less at Post Close. (5% or less at the Pre-fund stage).

- Aggregators could refuse to buy the loans, or squeeze already tight profit margins

- State and federal regulators could revoke licenses

- A declining reputation could affect loan volumes and profits

- Margins move into negative territory

No one in the mortgage ecosystem—brokers, loan officers, realtors, or borrowers—wants to work with a lender that closes a loan and then must bring the borrower back to the table to re-sign or even renegotiate loan terms, or requests additional documentation.

Example: one lender we spoke with at last year’s MBA Annual Convention in Nashville said they were auditing 100% of their loans, pre-funding, to ensure that they didn’t run the risk of having to buy the loan back or incur a penalty with a cost of up to 30% on the loan amount. If we do the math: 30% of a $300,000 mortgage is $90,000. For one loan. And how were they auditing the loans? With people. After having shed over half their workforce. This is not sustainable, especially with negative profit margins.

And can you imagine the compounding chaos if FHFA had not rescinded the debt-to-income-based loan-level pricing adjustment they had proposed this past January?

Still, significant challenges remain. How are lenders addressing these converging challenges? Innovative mortgage lenders are investing in back-office technologies predicated on a cloud and digital first strategy; and leaders are investing in intelligent automation.

Intelligent Automation is a combination of artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA2) that enables companies to offload repetitive “swivel chair” tasks to digital workers, or BOTS3, enabling valuable resources to deliver services higher up the value chain. With AI, ML and RPA, the opportunity to accelerate the “loan origination to close” processes while containing costs and driving efficiencies has arrived.

The business benefits gained by deploying intelligent automating to the back-office mortgage fulfillment processes include:

- Higher loan quality and loan accuracy, helping to satisfy the new GSE audit requirements and eliminate potential penalties, both reputational and fiscal

- Faster loan throughput times, allowing the same number of processors to do more with less

- Reduced cost per loans, the savings going straight to increasing profitability

- 24×7 loan processing at anytime of day, or night, further increasing loan throughput and enhancing customer service

- Scale up, or down by provisioning technology resources instead of human processors, literally at the touch of a keystroke

Not only can Intelligent Automation help quickly address the new compliance requirements and improve loan quality, but it also helps lenders to:

- Increase competitive advantage: Automation can help mortgage lenders stay ahead of the competition by offering faster, more efficient, and higher-quality back-office services

- Enable Digital Transformation: The shift towards digital channels and the increasing demand for online services have made automation a critical component of any successful digital transformation strategy

- Address New Regulations: The increasing complexity and volume of regulations related to mortgage lending make automation a necessary tool for ensuring compliance and reducing legal liabilities

- Manage customer expectations: Consumers today expect fast, convenient, and transparent loan services, and automation can help mortgage lenders meet these expectations

- Enable Data-driven decision making: Automation can help mortgage lenders make data-driven decisions by providing them with real-time data and insights that can improve loan quality and reduce risk

So where and how does a mortgage lender start, and what questions should a mortgage lender ask when embarking on the automation journey? There are three categories of questions: Business, Process and Technology.

Business

- Is there a business case for automation? What is the ROI, and when will it be reached?

- What are the success metrics (KPIs)?

- What is the available budget, and is there a solution that doesn’t require investing hundreds of thousands of dollars up front, and can be paid for on a per loan basis?

- In what part of the back-office will automation have the highest impact on returns?

Technology

- Are the necessary IT development and deployment skills available in-house?

- Must the solution be maintained in-house, or is there a need for an outside expert?

- Is there a ready-made solution for mortgage lenders that is easy to deploy and manage?

Process

- What are the most inefficient and margin-impacting processes?

- Do current processes need to be reconfigured—will good money be thrown after bad if they are not?

Once a lender has made the decision to automate, they need to consider what processes to automate first, look for wins as quickly as possible, measure the ROI, and use that momentum to invest in further automation.

Key considerations when scoping out the initial processes to automate include:

- What are the Loan Volumes and what is the current Processing Time for each process

- What are the current Error Rates within a discrete process e.g., Loan Setup, Post-Close Audit

- Can the process be fully automated (straight through process, e.g., Lock Confirmation) or does it require a human-in-the-loop e.g., Pre-Fund Audit, Pre-UW Audit

- What are the Customer Experience Key Performance Indicators (KPIs) i.e., what do customers measure the lender on e.g., Net Promoter Scores, Price, Turn Around Times

Supporting technical considerations include:

- Are the underlying applications stable? i.e., what is the system of record’s (LOS) uptime?

- Are the inputs to the process Structured (e.g., loan number, date fields) vs. Unstructured (e.g., data extracted from paragraphs like from a Deed of Trust)

- Are the systems’ Application Programming Interfaces (APIs) available or can the automation solution only interact with the system through RPA Bots?

Conclusion

By using automation to solve for new compliance requirements and increase profitability, lenders not only improve the loan quality, help decrease their turnaround times and reduce costs, but also increase efficiencies by freeing up employees to focus on higher ROI work. The outcome is that customers receive approvals and funding faster, with cost savings passed on to them with easier, more accurate, lower-cost lending, boosting the lender’s brand and enabling scale. After all, a mortgage is a commodity, and mortgage lenders must differentiate through better efficiencies, lower costs, and superior customer service. Intelligent automation enables all of this.

Footnotes

1CU scores: “Collateral underwriter” scores. An automated score that the GSE’s put on an appraisal. If it is too high there is a high risk associated with that property maintaining its value. The main critical defects are associated to Credit (borrower’s ability to pay) and Collateral (property value is solid).

2What is Robotic Process Automation (RPA)? RPA is a software platform that enables the creation, deployment and orchestration of BOTS that emulate human actions interacting with digital systems and programs. An RPA platform consists of multiple BOTs and manages, coordinates, and synchronizes the tasks of the BOTs much like a human manager or supervisor would.

3What is a BOT? A BOT (roBOT, get it?), also known as a Digital Worker, is a software program that performs automated, repetitive, pre-defined tasks. BOTS typically imitate a human user and can perform tasks at a faster rate and more accurately. For example, a BOT can be programmed to enter expense receipt data into a company’s finance system, or it can type information from a claims form directly into the claims platform. What are called “swivel-chair” tasks, where a human reads the data from a physical document on her left and types it into the keyboard on her right. Back and forth. Of course, the data must be extracted, or machine read, from an underlying document; that task can be performed by another BOT, one that can read characters, words and strings of data using context-driven logic or key value pair logic. But we digress.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Michael Tucker, Editor, at mtucker@mba.org.)