CBRE: Office Attendance Changes Prompt Companies to Revamp Office Portfolios

More companies now require office attendance than a year ago, causing them to change their office footprint to match office attendance patterns, reported CBRE, Dallas.

CBRE surveyed 207 companies with U.S. offices and found 65% said they require at least some in-office work, more than double the figure from a year ago.

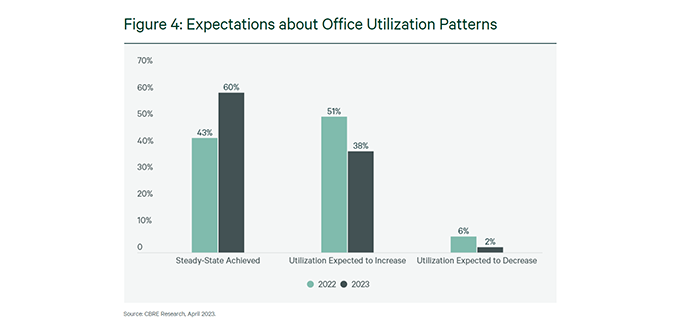

The office sector still faces significant challenges, though. Kastle Systems, Falls Church, Va., said office occupancy remains around 50% in the 10 cities it tracks for its monthly Back to Work Barometer. “Since the end of January, the Back to Work Barometer has hovered around 50% occupancy,” Kastle said. “Any significant changes in occupancy can be traced to weather events, holidays or other local interruptions that impacted cities’ office attendance, bringing down the overall average. This consistency shows that we may have reached a ‘new normal’ for office occupancy, at least for now.”

And the Wall Street Journal reported this week office owners have started to sell troubled office buildings at “fire-sale prices.” The newspaper called the trend a sign that office landlords are ready to capitulate.

The CBRE Spring 2023 U.S. Office Occupier Sentiment Survey said office sector dynamics have prompted more companies to shrink their office footprint to match attendance patterns. Well over half of companies surveyed said they expect their office portfolios to get smaller over the next three years compared to 46% that anticipate either no change or expansion.

“Companies increasingly have multiple options to reshape their office portfolios to accommodate attendance patterns, employee preferences and market dynamics,” CBRE said. Fifty-eight percent reported renewing their leases, sometimes for less space. Just under half have allowed leases to expire and 32% plan to relocate to better quality space. Forty percent said they are revisiting their existing lease terms now that occupiers have more negotiating leverage.

“Real estate evolves to accommodate changes in human behavior, and we’re seeing that as the office market adapts to hybrid work,” said Manish Kashyap, CBRE Global President of Advisory & Transaction Services. “This means greater flexibility in lease terms, more occupiers gravitating to higher quality office space and an increase in adaptive reuse of obsolete buildings.”

But despite the sector’s stress, the office remains a “cornerstone of employee engagement,” CBRE noted. “Our survey found that more than three-quarters of companies want employees in the office at least half the time.”

CBRE noted differing approaches to office attendance by two of the largest U.S. industries, technology and finance/professional services. “In many cases, finance and professional services companies are taking a more proactive approach to attendance than are technology companies,” the report said.

Julie Whelan, CBRE Global Head of Occupier Research, said top executives at finance companies tend to focus more on office attendance, especially amid economic uncertainty, than their counterparts at tech companies. “Similarly, finance and professional services companies are more likely to encourage employees to spend most of their work days at the office, while tech companies are more likely to allow mostly remote work,” she said.