Redfin: February Relocation Numbers Fall

Redfin, Seattle, reported fewer homeowners are looking to relocate, but higher mortgage rates aren’t the culprit.

The company said the number of Redfin.com home searchers looking to relocate to a new metro fell 3.6% year over year in February, with 14.4% fewer Redfin.com home searchers looking to relocate within their current metro. Those are both the biggest declines in Redfin’s records, which go back through 2018.

However, the report noted while the rise in mortgage rates over the past year has made purchasing a home more expensive almost across the board, elevated rates often aren’t as big of a deterrent for relocating homebuyers because they’re typically moving to more affordable areas. Someone moving from Los Angeles to Las Vegas, for instance, could buy a home comparable to the one they’re selling in Los Angeles for half the price.

“High rates don’t impact that buyer as much because they’re getting a cheaper house and may be using proceeds from a home sale in a more expensive area,” the report said. “People moving from one part of the country to another may also be doing so for a higher-paying job, which would help offset high mortgage rates.”

Additionally, the report said homebuyers relocating to a different part of the country may have a non-negotiable reason for their move, such as for a higher-paying job, or to be closer to family. “High rates are less likely to deter those homebuyers than ones simply considering a different house within the same town,” the report said.

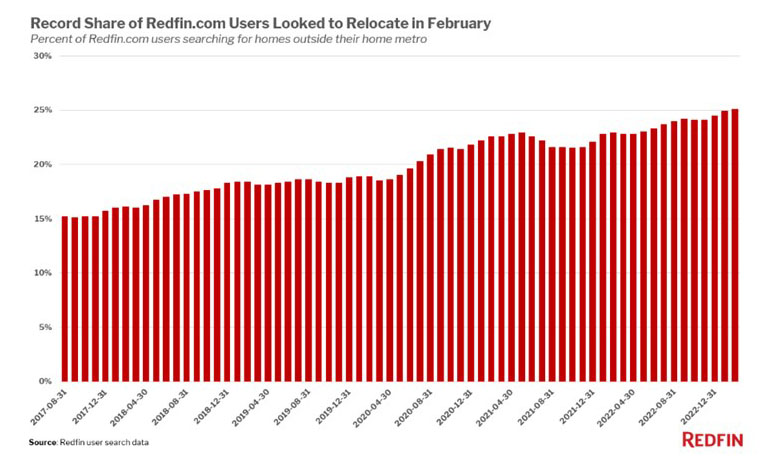

One statistic that is up: 25.1% of house hunters nationwide looked to relocate to a new metro in February, a record high. That’s up from 22.9% a year earlier and 18% before the pandemic. The report said relocators made up a bigger portion of homebuyers than ever because elevated mortgage rates, still-high home prices, inflation and economic uncertainty are motivating the few people who are still buying homes to move to more affordable areas. Remote work has also made it more feasible for Americans to relocate.

Miami, Phoenix, Las Vegas, Sacramento, Calif., and Tampa, Fla., were the most popular destinations for house hunters looking to move to a different metro in February. Other parts of Florida and a couple Texas metros round out the top 10: Orlando, Cape Coral, Dallas, North Port-Sarasota and Houston. While homes in these places cost considerably more than pre-pandemic, they remain comparatively affordable. The typical home in most of the popular destinations is less expensive than the typical home in the top origins. The typical Miami home sold for $485,000 in February, compared with $640,000 in New York, the most common origin for homebuyers looking to move in. And the typical Phoenix home sold for $425,000, compared with $710,000 Seattle, the most common origin.

“For buyers coming from the Bay Area or another expensive place, homes in Phoenix seem cheap. That’s why out-of-towners are still buying homes even though rates are high,” said Phoenix Redfin agent Heather Mahmood-Corley. “Desirable, well-priced homes are selling quickly, sometimes with a bidding war–largely because there are still so many buyers moving in from out of town.”

Homebuyers looked to leave San Francisco, New York and Los Angeles more than any other metro in February, followed by Washington, D.C. and Chicago. While San Francisco tops the list of places people are looking to leave, fewer homebuyers are leaving than a year ago. That may be partly because Bay Area home prices are falling.