CoreLogic: Mortgage Delinquencies Fall for 22nd Straight Month

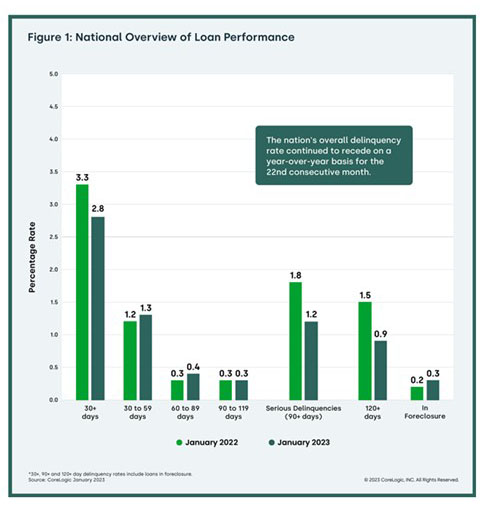

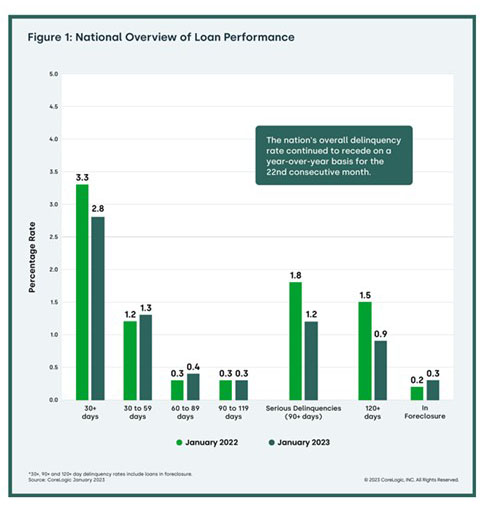

CoreLogic, Irvine, Calif., said 2.8% of all mortgages in the U.S. were in some stage of delinquency, down by 0.5 percentage point from 3.3% in January 2022 and by 0.2 percentage point from December.

This marked the 22nd consecutive month of annual drops in the delinquency rate. Other findings from the company’s monthly Loan Performance Insights Report:

–Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in January 2022.

–Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in January 2022.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.2%, down from 1.8% in January 2022 and a high of 4.3% in August 2020.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, up from 0.2% in January 2022.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 0.7% in January 2022.

“The share of home loans in all stages of delinquency continues to decline, down from a high of 7.3% in the spring of 2020 and down by 0.5 percentage points from January 2022,” said Molly Boesel, principal economist with CoreLogic. “The annual decrease in overall delinquencies was primarily driven by a large decline in the share of mortgages six months or more past due. Despite the drop in overall delinquencies, the foreclosure rate has slowly crept up. Although it remains near an all-time low, about 30,000 more U.S. homeowners are now involved in the foreclosure process.”

The report said no state posted an annual increase in its overall delinquency rate in January. States with the largest declines were Alaska, New York and Washington, D.C. (all down by 1 percentage point). The other states’ annual delinquency rates dropped between 0.9 and 0.1 percentage points.

The report also noted 25 metro areas posted an increase in overall delinquency rates. The top three areas for mortgage delinquency gains year over year were Punta Gorda, Fla. (up by 2.1 percentage points), Cape Coral-Fort Myers, Fla. (up by 2 percentage points) and Mansfield, Ohio (up by 0.5 percentage points). All but two U.S. metro areas posted at least a small annual decrease in serious delinquency rates (defined as more than 90 days late on a mortgage payment). The metros that saw serious delinquencies increase were Cape Coral-Fort Myers, Fla. (up by 1.5 percentage point) and Punta Gorda, Fla. (up by 1.4 percentage points).