Strong February Job Growth Muddies Fed Outlook

Employers added 311,000 jobs in February, the Bureau of Labor Statistics reported Friday—good news for the labor market but complicating news for the Federal Reserve, which faces the daunting task next week of encouraging economic growth while taming inflation.

The report said total nonfarm payroll employment rose by 311,000 in February, while the unemployment rate edged up to 3.6 percent as more workers entered the job market. Notable job gains occurred in leisure and hospitality, retail trade, government and health care. Employment declined in information and in transportation and warehousing.

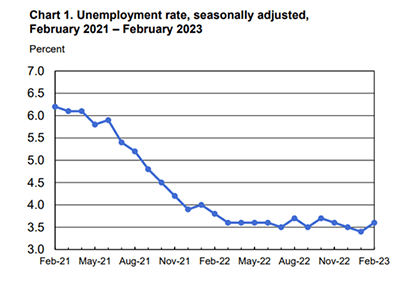

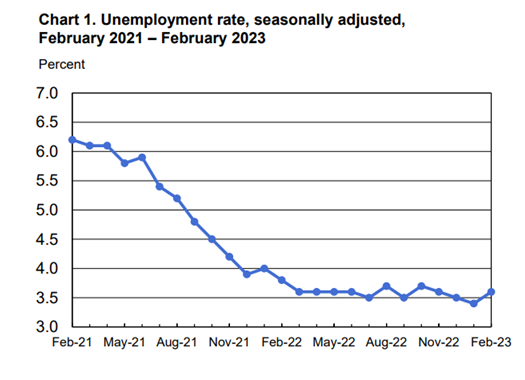

Both the unemployment rate, at 3.6 percent, and the number of unemployed persons, at 5.9 million, edged up in February. However, these measures have shown little net movement since early 2022. The labor force participation rate was little changed at 62.5 percent, and the employment-population ratio held at 60.2 percent. These measures have shown little net change since early 2022 and remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively).

BLS revised total nonfarm payroll employment for December down by 21,000, from +260,000 to +239,000, for January down by 13,000, from +517,000 to +504,000.

“February’s employment numbers showed slower job growth, primarily in the lower wage services sectors of the economy, which accounted for 245,000 of the 311,000 jobs gained,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Growth in industries such as retail, leisure, and hospitality are still reflecting a catch-up from the pandemic.

Federal Reserve Chair Jerome Powell, in testimony before Congress last week, said incoming data on the U.S. economy continues to show strength and that a higher level of interest rates, and potentially for a longer period, is likely needed to cool inflation. “On net, this report does show some slowing, particularly with respect to the breadth and the amount of job growth,” Fratantoni said. “The unemployment rate increased to 3.6 percent, partly driven by another increase in labor force participation, but remained well below historical averages. We expect the unemployment rate to increase over the course of this year as the economy cools, reaching 4.8 percent at the end of the year.”

Fratantoni noted the housing market typically benefits from strong employment conditions, “but as monetary policy has tightened to combat inflation, bringing about higher rates and tighter financial conditions, homebuyers have pulled back over the past year. We expect the economy to go into a mild recession this year, and with that a cooling in home prices and lower mortgages rates, which should help affordability conditions and bring a gradual recovery in housing activity.”

“The prime-age labor force participation rate increased to 83.1%, and it’s now back to the pre-pandemic level. Job growth remained strong but is moderating,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Wage growth climbed by 0.2% in February, which was the slowest monthly increase since February 2022. In the topsy-turvy, upside-down economic world we are in, rising unemployment and falling wage growth are a good thing for the inflation fight.”

Kushi said the report “still reflects a strong labor market. Indeed, nearly a year into the central bank’s aggressive monetary tightening campaign, the labor market continues to show some immunity. A stronger prime-age labor force participation rate means a higher supply of labor and thus could help companies fill open jobs. The mismatch between labor supply and demand is a driver of wage growth, so more labor supply could help to counter wage growth.”

“While hiring remained on roll, there were hints that strong job growth need not come at the expense of fanning inflation pressures,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Even with February’s increase in the unemployment rate, the labor market remains incredibility tight. While we expect hiring to slow more markedly from here, there remains plenty of scope for the jobs market to weaken before concerning the Fed. We expect the FOMC to remain in tightening mode awhile yet, with the bar for a 50 bps hike at the upcoming March meeting looking somewhat higher after today’s report showing some easing of inflation pressures coming from the jobs market.”

BLS said average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents, or 0.2 percent, to $33.09. Over the past 12 months, average hourly earnings have increased by 4.6 percent. In February, average hourly earnings of private-sector production and nonsupervisory employees rose by 13 cents, or 0.5 percent, to $28.42.

The report said the average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.5 hours in February. In manufacturing, the average workweek edged down by 0.2 hour to 40.3 hours, and overtime edged down by 0.1 hour to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.2 hour to 33.9 hours.