February New Home Purchase Mortgage Applications Up 4%

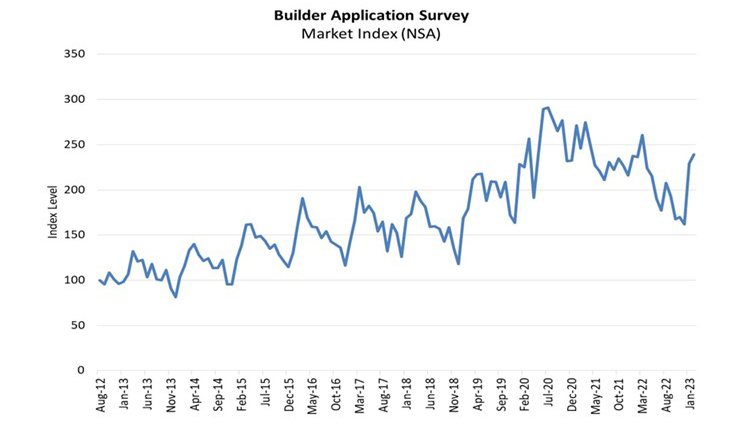

The Mortgage Bankers Association on Thursday reported mortgage applications for new home purchases increased by 4 percent in February from January and by 1.2 percent from a year ago.

The MBA Builder Applications Survey reported by product type, conventional loans composed 69.9 percent of loan applications, FHA loans composed 20.0 percent, RHS/USDA loans composed 0.3 percent and VA loans composed 9.8 percent. The average loan size of new homes increased from $401,631 in January to $406,953 in February.

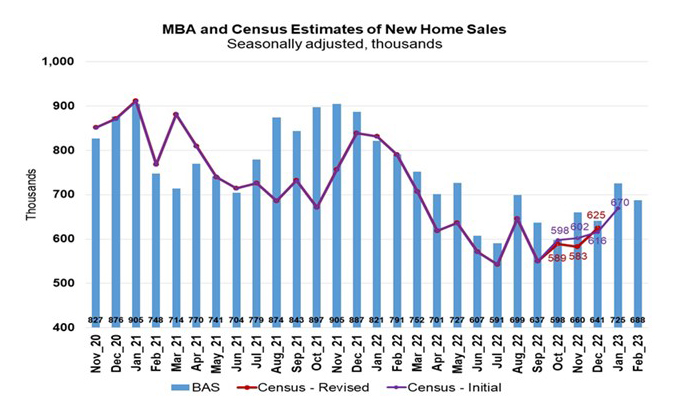

MBA estimated new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, at a seasonally adjusted annual rate of 688,000 units in February, a decrease of 5.1 percent from the January pace of 725,000 units. On an unadjusted basis, MBA estimated 61,000 new home sales in February 2023, a decrease of 3.2 percent from 63,000 new home sales in January.

Changes do not include any adjustment for typical seasonal patterns.

“The uptick in new home purchase applications showed a seasonal pickup and that segment of the market continues to show healthier activity than the broader purchase market, which is still showing annual declines of over 30 percent,” said Joel Kan, MBA Vice President and Deputy Chief Economist. “Buyers, however, remain extremely sensitive to movements in mortgage rates and the broader economy. Mortgage rates picked up in February, which put a damper on housing activity.”

Kan noted the 5 percent drop in the estimated new home sales pace for February to 688,000 units reversed a January gain when buyers had a brief respite from rising mortgage rates, combined with discounts and concessions from sellers. “The decline in new home sales is likely less than that for existing home sales as home builders are motivated to sell homes in their construction pipeline,” he said.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors. Changes do not include adjustments for typical seasonal patterns.

The MBA Builder Applications Survey tracks application volume from mortgage subsidiaries of home builders across the country. Using these data, as well as data from other sources, MBA provides an early estimate of new home sales volumes at the national, state and metro level. These data also provide information regarding types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In those data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

For additional information on the MBA Builder Applications Survey, click here.