CoreLogic: 4Q Home Equity Gains Slow Further

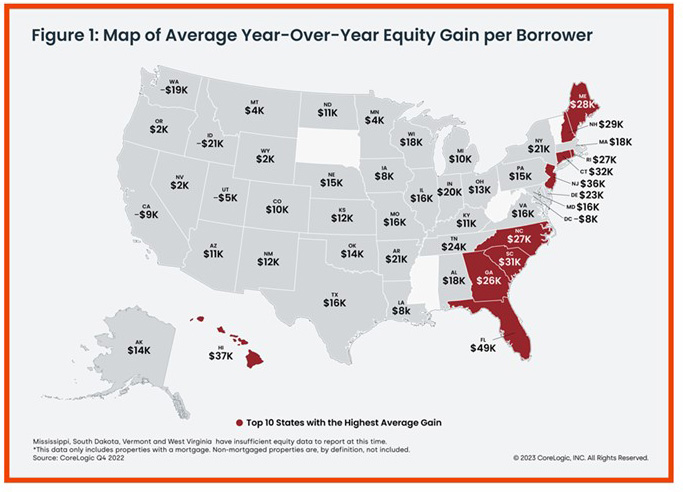

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for roughly 63% of all properties) saw equity slow to a 7.3% increase year over year, representing a collective gain of $1 trillion, for an average of $14,300 per borrower, from one year ago.

The company’s quarterly Homeowner Equity Report noted as U.S. home price growth continued its slow, steady decline in the final months of 2022, home equity trends naturally followed suit. In the fourth quarter, the average borrower earned about $14,300 in equity year over year, compared with the $63,100 gain seen a year ago.

Four Western states and one district posted annual home equity decreases: Idaho (-$21,400), Washington (-$18,900), California (-$8,500), Utah (-$4,600) and Washington, D.C. (-$8,300). This partially mirrors trends recorded in CoreLogic’s latest Home Price Index, which found that Idaho, Washington and Washington, D.C. saw home price growth decline slightly year over year in January 2023.

On the flip side, Florida homeowners saw the highest annual equity growth in the fourth quarter, at $49,000. Florida has posted the largest year-over-year home price gains in the country for the past year, according to HPI data, with prices up by 13.4% in January.

“While equity gains contracted in late 2022 due to home price declines in some regions, U.S. homeowners on average still have about $270,000 in equity more than they had at the onset of the pandemic,” said Selma Hepp, chief economist with CoreLogic. “Even in Idaho, where borrowers were the most vulnerable to losses, the typical homeowner with a mortgage still has about $250,000 in remaining home equity.”

Hepp noted with 66,000 borrowers entering negative equity in the fourth quarter, underwater properties are now approaching levels not seen since the end of 2021, which was the lowest since the Great Recession. “The new hot spots for equity declines are largely markets that have seen the most significant home price deceleration, including Boise, Idaho; the San Francisco Bay Area; cities in Utah; Phoenix and Austin, Texas,” she said.

Other report findings:

· Quarterly change: From the third quarter to the fourth quarter, mortgaged homes in negative equity increased by 6%, to 1.2 million homes or 2.1% of all mortgaged properties.

· Annual change: From fourth quarter 2021 to fourth quarter 2022, homes in negative equity declined by 2% to 1.2 million homes or 2.2% of all mortgaged properties.

CoreLogic said should home prices increase by 5%, 145,000 homes would regain equity; should home prices decline by 5%, 215,000 properties would fall underwater.