Mortgage Credit Availability Down in May

(Courtesy of Mortgage Bankers Association; Powered by ICE Mortgage Technology)

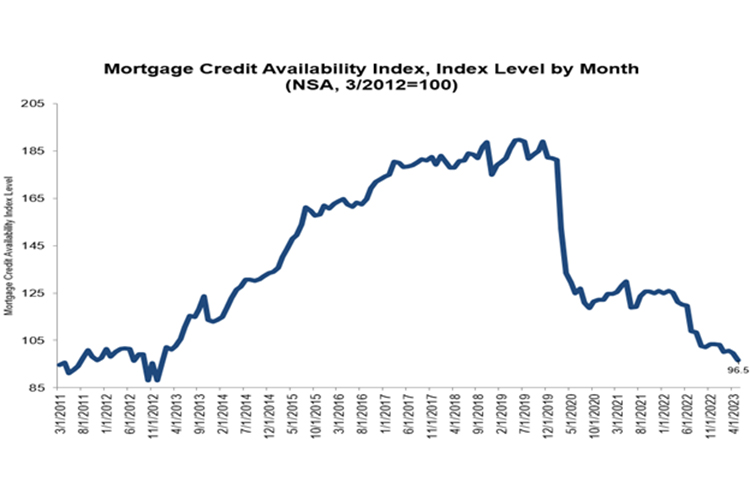

Mortgage credit availability fell in May, the Mortgage Bankers Association reported Tuesday.

The Mortgage Credit Availability Index fell by 3.1% to 96.5. The Conventional MCAI decreased 2.3%, while the Government MCAI decreased by 3.8%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.5% and the Conforming MCAI fell by 3.9%.

“Mortgage credit availability decreased for the third consecutive month, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market. With this decline in availability, the MCAI is now at its lowest level since January 2013,” said Joel Kan, MBA Vice President and Deputy Chief Economist. “The Conforming index decreased almost 4% to its lowest level in the history of the survey, which dates back to 2011. The Jumbo index fell by 1.5% last month, its first contraction in three months, as some depositories assess the impact of recent deposit outflows and reduce their appetite for jumbo loans.”

Kan also noted lenders pulled back on loan offerings for higher LTV and lower credit score loans, even as loan applications remain well behind 2022’s pace. “Both Conventional and Government indices saw declines last month, and the Government index fell by 3.8% to the lowest level since January 2013. In a market where a significant share of demand is expected to come from first-time homebuyers, the depressed supply of government credit is particularly significant,” Kan said.

The MCAI analyzes data from ICE Mortgage Technology. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

About the Mortgage Credit Availability Index

The MCAI provides the only standardized quantitative index solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via the AllRegs Market Clarity product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To learn more about the ICE Mortgage Technology, visit http://answers.allregs.com/MCAI-Market-Clarity. For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, visit www.mba.org/MortgageCredit or contact MBAResearch@mba.org.