CoreLogic: Single-Family Home Price Growth 2% in April

(Courtesy CoreLogic)

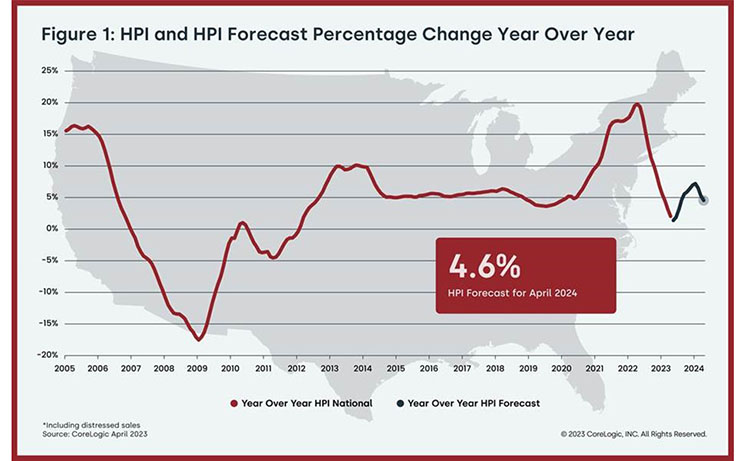

CoreLogic, Irvine, Calif., reported single-family home price growth of 2% year-over-year in April, the lowest recorded change since March 2012.

CoreLogic forecasted home price growth will continue to be slow through much of 2023 but regain steam to about 5% annual appreciation by April 2024.

While April represents the 135th consecutive month of year-over-year growth, gains in recent months have slowed to single digits, CoreLogic said in the release of its Home Price Index and HPI Forecast for April. On a month-over-month basis, home prices were up 1.2% from March 2023.

“While mortgage rate volatility continues to cause buyer hesitation, the lack of for-sale homes is putting firm pressure on prices this spring, leading to above-average seasonal monthly gains and a rebound in home prices in most markets,” said CoreLogic Chief Economist Selma Hepp. ”Nevertheless, the recent surge in mortgage rates and continued inflation issues suggest that rates may remain elevated, leading home price appreciation to possibly relax this summer and return to average seasonal gains later in 2023.”

“Still, while slim inventory is pushing prices up once again and constraining affordability,” Hepp continued, “recent trends suggest that home price growth in 2023 will fall in line with the historical 4% annual average.“

Recent Federal Housing Finance Agency and Case-Shiller Home Price Index reports also showed modest gains.

FHFA said house prices were up 0.5% compared with fourth-quarter 2022. FHFA’s seasonally adjusted monthly index for March was up 0.6% from February. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 0.7% annual gain in March, down from 2.1% in the previous month.

CoreLogic’s state-by-state data showed annual declines in home prices in Arizona, California, Colorado, Idaho, Montana, Nevada, New York, Oregon, Utah and Washington. Indiana and New Jersey saw the highest year-over-year increases at 7.3% and 7.1%, respectively.

For metro areas, Miami posted the highest year-over-year home price increase of the country’s 20 tracked areas in April, at 13.2%, while Atlanta ranked second at 4.8%.

The firm also projected markets at the biggest risk for home prices declining. Lakeland-Winter Haven, Fla., topped that list, followed by Provo-Orem, Utah; North Port-Sarasota-Bradenton, Fla.; Cape Coral-Fort Myers, Fla. and Port St. Lucie, Fla.