Small-Cap Office Buildings Buck Concerns in Q1

Conventional thinking says the office market is in crisis, but Boxwood Means, Stamford, Conn., found small-cap office properties aren’t seeing the same trends.

Per Randy Fuchs, Boxwood Means Principal and Co-Founder, small-cap office buildings have outperformed larger buildings and largely escaped broader office building upheaval.

Takeaways from Boxwood Means’ analysis of first-quarter CoStar occupancy data involving small office buildings under 50,000 square feet include:

Demand is down, but not by much. “The small-cap office market represents roughly half of the total [rentable building area] of the national office sector’s 8.4 billion square feet,” Fuchs said. “While occupancy losses among smaller-sized buildings amounted to nearly 5 million square feet in Q1, this total was only a quarter of the total negative net absorption for the sector in the aggregate.”

There was moderate growth in available space. The office availability rate, which combines sublease space, other marketable tenant space and physically vacant offices, rose 20 basis points year-over-year to 8.5% among small buildings. However, that compares with 9.4% at the pandemic peak and 10.5% over the long term.

Sublease space rose slightly. One million square feet of sublease space was added in the quarter, raising the small-cap sublet availability rate by 10 basis points year-over-year to 0.5% of total inventory, or 20.5 million square feet. That represents only about 10% of the 213 million square feet of sublease space available nationwide.

“An office apocalypse for small caps isn’t in the cards–at least by one forward-looking measure,” Fuchs said.

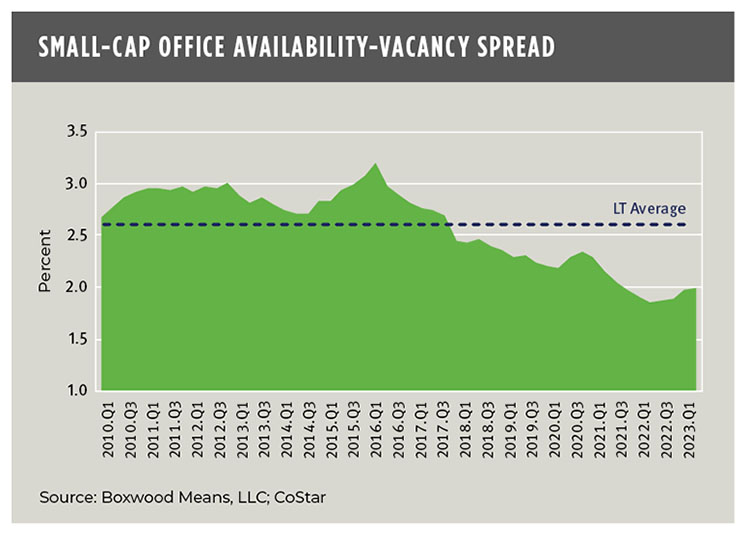

“The relationship over time between the availability rate and the total vacancy rate is a window onto evolving occupier fundamentals. Generally speaking, an office market is performing well when the spread between the two is narrowing, i.e., demand is outpacing supply,” he continued. “Conversely, if the gap between the availability rate and the total vacancy rate is wide or growing, it indicates that office leasing conditions are relatively soft with sublet space lingering on the market and periods of negative net absorption.”

The 200-basis point spread between small-cap market availability and vacancy is near its recent low point over the past 13 years and below the long-term average.

Fuchs pointed to a few reasons for small-cap office buildings’ weathering of the storm, including that many occupants are smaller companies with conservative office footprints, leases tend to be slightly shorter and cheaper, and the buildings are often concentrated in suburban locations with shorter commutes.