DLA Piper Survey Finds Bearish Outlook Among CRE Leaders

(Courtesy DLA Piper)

DLA Piper, London, reported its annual survey showed an overall bearish outlook among leaders in the commercial real estate industry, but it also found optimism in some sectors.

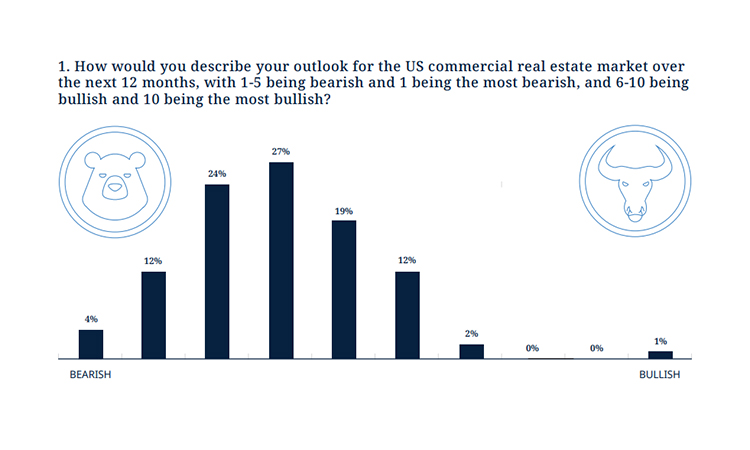

The firm’s 2023 Global Real Estate Annual State of the Market Survey showed 86% of respondents reported being bearish about the next year in commercial real estate–a sharp contrast from last year’s survey, which had 73% of respondents with a bullish outlook.

DLA Piper noted this is only the second year since the first release of its survey (2009) that the report has shown projections for a bear market. This year’s study was conducted in February and March.

Unsurprisingly, interest rates were weighing heavily on respondents’ minds–46% cited interest rate hikes as the reason for their bearishness.

Moreover, 83% of respondents said interest rates will have the biggest impact on the market, and 92% believe that interest rate increases will have a negative impact on investments in CRE in 2023. When asked about the factors that will be most impactful on the CRE market in the next year, 98% of survey respondents also noted challenges in refinancing existing debt.

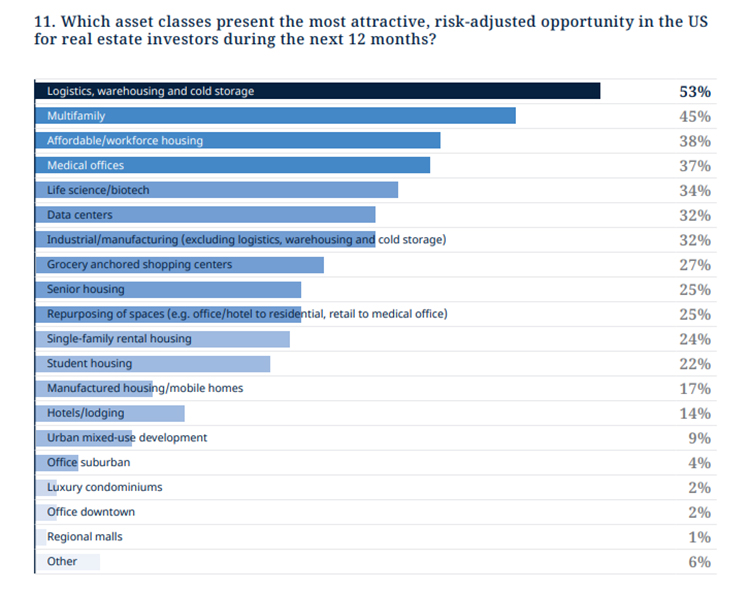

However, respondents noted strong underlying market fundamentals in some classes, including logistics, warehousing, and cold storage, multifamily, and affordable and workforce housing. Also listed were types of commercial real estate that address basic needs, such as medical offices, grocery-anchored retail and senior housing.

DLA Piper highlighted responses regarding the office sector, as that will continue to have large impacts on CRE outlooks in coming years.

Per the survey, 72% of respondents didn’t believe occupancy in office buildings will increase over the next year, and 43% believe office vacancies will never return to pre-pandemic levels–a notable jump from just 20% last year.

“While changes in how today’s workforce uses traditional office space are creating challenges, they also provide opportunities for careful and creative investment,” said John Sullivan, U.S. Chair of DLA Piper’s Real Estate practice and Global Co-Chair of its Real Estate sector. “Fundamental shifts in the way spaces are used are rare, and the rapid transformation of how and where people work offers an opportunity for creative conversion and reimagination of some spaces. Nonetheless, it’s important to note that repurposing is not a one-size-fits-all solution for the office sector. In addition, there is continuing demand for new, amenity rich office buildings.”