Fannie Mae: Perceived Homebuying, Home-Selling Conditions Diverge Further in May

(Courtesy Fannie Mae, Washington, D.C.)

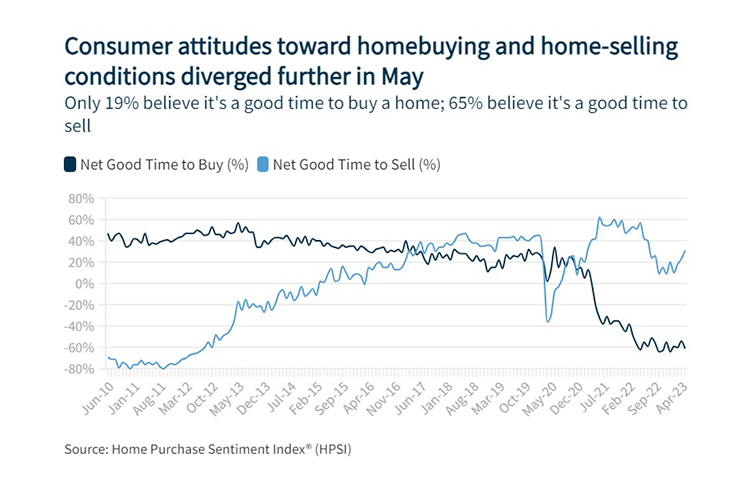

Fannie Mae, Washington, D.C., said its Home Purchase Sentiment Index decreased by 1.2 points in May to 65.6 as affordability constraints continue to color consumers’ perceptions of homebuying and home-selling conditions.

The GSE said four of the HPSI’s six components decreased month over month, most notably the component polling consumers’ belief this is a “good time to buy,” which is once again nearing its survey low. The “good time to sell” component, however, increased in May to its highest level since last July.

Additionally, for the second consecutive month, a greater share of consumers indicated that they expect home prices to increase over the next year. The full index is down 2.6 points year over year.

“As we near the end of the spring homebuying season, the latest HPSI results indicate that affordability hurdles, including high home prices and mortgage rates, remain top of mind for consumers, most of whom continue to tell us that it’s a bad time to buy a home but a good time to sell one,” said Mark Palim, Fannie Mae vice president and deputy chief economist. “Consumers also indicated that they don’t expect these affordability constraints to improve in the near future, with significant majorities thinking that both home prices and mortgage rates will either increase or remain the same over the next year.”

Palim said the same factors affecting affordability may also be affecting the perceived ease of getting a mortgage. “This was particularly true among renters,” he said, noting 81% believe it would be difficult to get a mortgage today, matching a survey high.

The percentage of respondents who said home prices will go up in the next 12 months increased from 37% to 39%, while the percentage who said home prices will go down decreased from 32% to 28%. The share who said they think home prices will stay the same increased from 31% to 33%. As a result, the net share of those who say home prices will go up increased 6 percentage points month over month.

Fannie Mae reported the percentage of respondents who think mortgage rates will go down in the next 12 months decreased from 22% to 19%, while the percentage who expect mortgage rates to go up increased from 47% to 50%. The share who think mortgage rates will stay the same remained unchanged at 31%. “As a result, the net share of those who say mortgage rates will go down over the next 12 months decreased 5 percentage points month over month,” the report said.