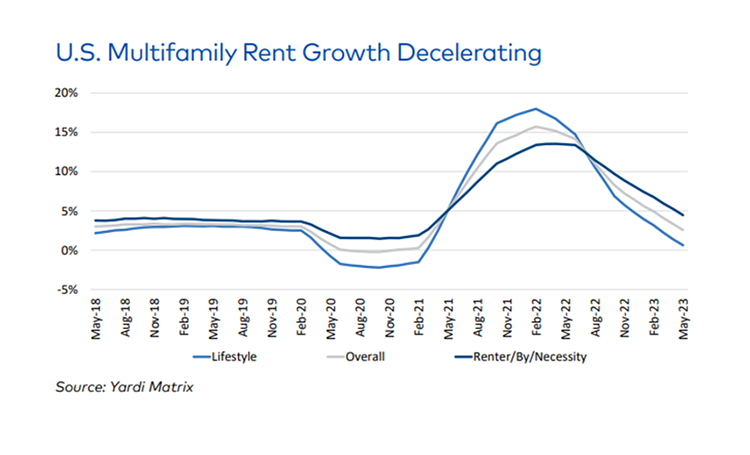

Yardi Matrix: Multifamily Rents See Small Growth in First Half of 2023

(Courtesy Yardi Matrix)

Yardi Matrix, Santa Barbara, Calif., found multifamily asking rents grew $17, or 0.9%, with year-over-year growth decelerating to 2.6% through the first five months of 2023.

The average U.S. apartment rent hit an all-time high in May, at $1,716.

The company forecasted rent growth of 2.5% for the full year, acknowledging the myriad headwinds for the market could spark that continued deceleration. On the list of factors to watch: interest rates, capital markets, job growth and demand.

One important factor has been home sales–high interest rates have stymied sales, keeping people in apartments longer. Household formation, which drove the significant growth in asking rents over 2021 and 2022, has slowed but remains positive.

“Households grew at a rapid rate after the pandemic as job growth boomed, young adults moved out of their parents’ homes, and work-from-home prompted renters to form their own households to gain more living space for offices, children and pets,” the report stated. “Although some pandemic demographic trends are moderating, the desire for more space that created household decoupling appears to have staying power which should drive apartment demand.”

For the capital side of the sector, property values are down 15-20% from their peak, and sales halfway into 2023 are 70% below 2022 levels.

New deliveries will be high through at least the end of next year, with 1 million units under construction expected to come online. But, construction starts are beginning to ebb amid high interest rates, Yardi Matrix noted.