Redfin Reports Housing Inventory Slump: 39% Fewer Homes for Sale Than Pre-Pandemic

(Courtesy of Redfin)

Redfin, Seattle, dug into the ongoing housing inventory crunch, finding there are 39% fewer homes for sale now compared with June 2018.

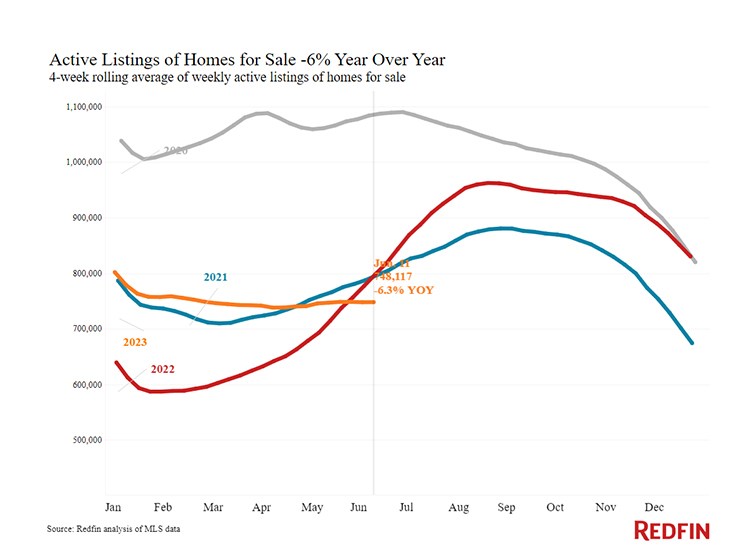

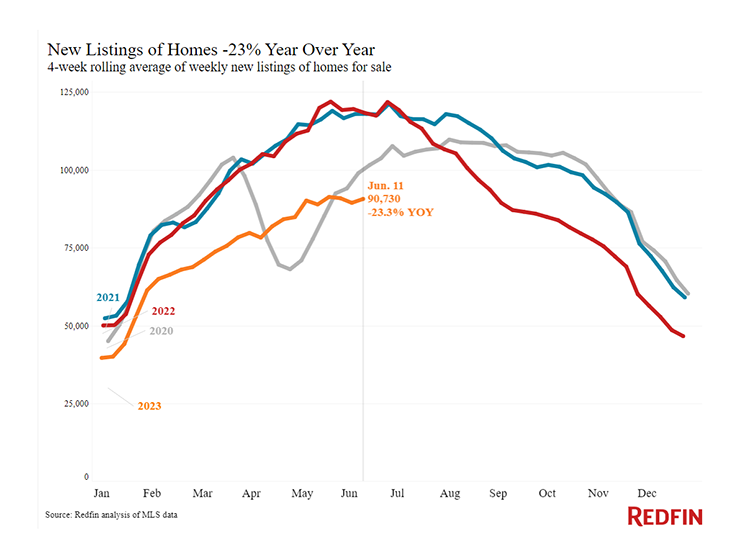

On a more short-term basis, Redfin noted the total number of homes for sale dropped 6% year-over-year during the four weeks ending June 11, the biggest decline in 13 months. Additionally, new listings fell 23% amid a 10-month streak of double-digit drops.

Redfin pointed to a homebuilding slump over the last decade, and the recent mortgage rate fluctuations as reasons for the inventory issues. But, buyers are still showing demand, and Redfin said it expects them to pounce when more homes become available.

The supply-demand imbalance is also preventing home prices from falling too much–the median sales price is down 1.1%, the smallest annual decline in three months.

Looking forward, Redfin note the latest Fed news make it unlikely that mortgage rates decline soon, potentially deepening the inventory challenges.

“The Fed’s indication that there are more rate hikes to come is not what homebuyers want to hear. It’s likely to keep mortgage rates elevated and may even push them up a bit,” said Redfin Economics Research Lead Chen Zhao. “People who are sitting on the sidelines, waiting for mortgage rates to decline, should know that’s unlikely to happen in the foreseeable future. If a home that’s in your price range and has everything on your wish list hits the market, there’s no good reason to wait.”

Redfin’s data largely covers the four-week period ending June 11. Redfin’s weekly housing market data goes back through 2015.