Housing Has Affordability, Supply Challenges, Harvard Finds

(Courtesy of Joint Center for Housing Studies of Harvard University)

Housing is currently prohibitively costly for millions of American households, per the Joint Center for Housing Studies of Harvard University’s State of the Nation’s Housing 2023 report.

Rising prices, construction patterns, cost burdens and mobility patterns over recent years are all factors weighing heavily on the center’s outlook, the annual report said.

Ultimately, housing costs remain well above pre-pandemic levels despite a cooling in various markets in recent months. Since early 2020, asking rents in the professionally managed sector are up by 24% and home prices are up 37.5%.

The report also pointed out that first-time homebuying is falling due to costs. There was a 22% annual decline in the number of mortgages for first-time homebuyers in 2022, and a year-over-year drop in Q4 of almost 40%. Buyers of color were particularly hard hit; Black and Hispanic homeownership rates were 28.6 and 25.8 percentage points, respectively, below white homeownership rates in 2022.

Looking at 2019-2021, the number of cost-burdened homeowners (defined as spending more than 30% of their income on housing) jumped the most since 2005-2007 to 19 million homeowner households, with 8.7 million defined as severely cost burdened (spending more than 50% on housing costs).

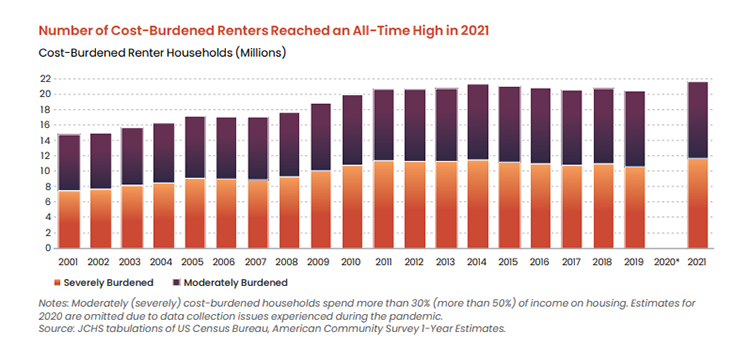

The number of cost-burned renters hit a record high of 21.6 million households, with 11.6 million renters defined as severely cost burdened

Adding to the pressure, single-family housing starts dropped 10.8% in 2022, although multifamily units saw strong numbers for now. And, the supply of low-cost rental units is continuing to decline, with 3.9 million units with contract rents below $600 lost from the market over the last decade.

Looking forward, especially as pandemic-related programs wind down, the report pointed to a need for investments across the housing spectrum, from lower-cost units to funds for aging housing and responses to climate change.

“In the face of ongoing debate about the need to pare back federal spending, now may not seem to be the right time to expand federal efforts to address the nation’s housing challenges,” the report stated. “But housing is a crucial engine of economic growth, and investments in this important sector pay broader dividends. As the pandemic highlighted, high-quality, stable, and affordable housing is foundational to widespread well-being and, as such, both merits and necessitates greater public attention.”