Sponsored Content from CreditXpert: The Often-Ignored, Highly Strategic 3rd “C” of Mortgage Lending

By Mike Darne, Vice President of Marketing with CreditXpert

From the outside, lending looks like a straightforward business. All you have to do is take the application from someone who wants a loan and determine whether or not you think they are a good risk for the deal and will repay the loan.

Of course, it’s not that simple. It never has been.

Back in the day, when community-based lenders were the only ones offering home financing, the lending committee knew the applicants living in the area. They had a pretty good idea of each applicant’s character and so it made sense that this was a foundational element in early loan underwriting.

But it wasn’t the only thing the lender looked at. They also needed to know if the applicant had the capacity to pay back the loan and, when consumer credit repositories entered the scene, whether their credit history indicated that they were a good risk.

Finally, there was the collateral. What does the appraiser say the home is worth and what does the committee think they can sell if for, if they have to take it back through foreclosure.

I know. MBA Members are well aware of this history, but I’m going somewhere with this.

The C that matters for mortgage lenders — and borrowers

Today, the three big factors that carry the most weight for mortgage loan underwriters are:

Capacity. Can the borrower make the payments?

Collateral. Is the LTV set right to offset future economic risk?

Credit. Does the borrower have a history of paying the bills?

There’s not much the lender can do about the first two C’s. The borrower has the funds they have and the property is worth what the appraiser says it’s worth.

For many years, lenders have assumed that there wasn’t much they could do about the third C either. But that turns out to be wrong.

Data we have amassed from analyzing millions of consumer credit pulls have shown that about 3 out of 4 mortgage loan applicants can raise their credit score by at least 20 points in about 30 days by taking a few simple actions.

Credit, as it turns out, is the only lever the lender can pull to help borrowers who just miss the credit box to qualify for a loan. It can also allow lenders to offer better deals to borrowers with higher credit scores, establishing borrower trust and allowing them to beat the competition.

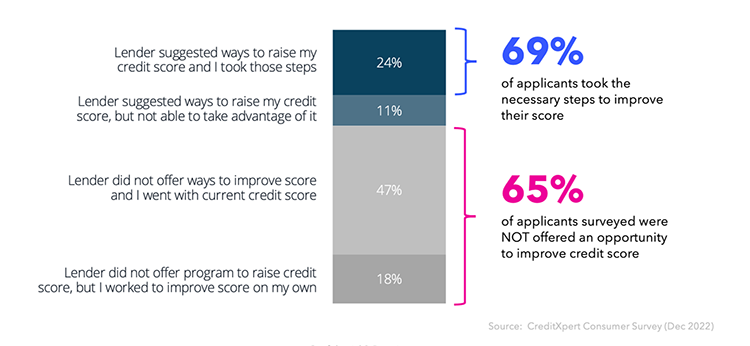

Despite this opportunity, 65% of recent loan applicants told us in a December 2022 survey that lenders never offered to help improve their credit score. This is a huge, missed opportunity.

Where new mortgage business is available now

According to the March 2023 Mortgage Credit Potential Index, CreditXpert analyzed 15.1 million mid-score credit pulls over the 12 months ending March 31, 2023 showed that 76% of all mid-score credit pulls below 760 may be able to increase their score by at least one 20-point band within 30 days.

In that 12-month period, there were 5.78 million total credit pulls between 640 and 750, which means that 4.14 million applicants could have increased their score.

So, how can lenders leverage borrower to attract and win this business? Here are five ideas any lender can implement now to be more competitive and increase profitability.

Start the credit conversation early.

Lenders who bake credit improvement for all into their process from the beginning have a better shot at keeping applicants from falling out due to competition. We know today’s home seekers are completing applications with several lenders. The one that wins their trust and offers the best deal will ultimately win their business.

Train LOs to sell credit as a differentiator.

If 65% of borrowers report that they are not being offered an opportunity to improve their score at the time of application, it means the majority of lenders aren’t having the credit conversation. They’re just assuming that the applicant’s credit is what it is. But it’s probably not. Smart lenders are differentiating among both lead sources AND among borrowers that are shopping around.

Don’t forget the emotional component of mortgage lending.

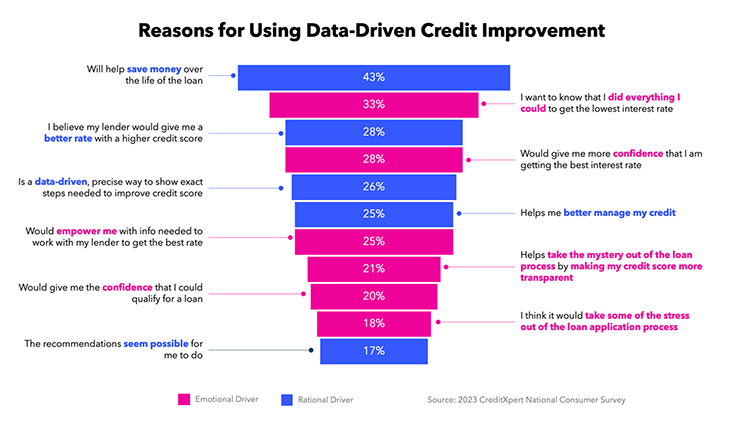

Lenders look at the numbers when underwriting loans and they assume that borrowers are doing the same thing, but our recent study showed that in some ways it less about the logic for them. There is a lot of emotion wrapped up in the consumer’s home buying journey. By working with the borrower to improve their credit, the LO has an opportunity to offer a number of emotional benefits (confidence, empowerment, transparency) that will go a long way toward establishing trust.

Look for business in the mid-scores first.

Based upon our internal data, we believe that 36% or more of the applicants that don’t initially qualify for a mortgage will follow through and put in the work to qualify if they are given the opportunity.

Higher scores lead to lower LLPA premiums.

In considering the impact that credit score has on Fannie Mae’s and Freddie Mac’s Loan Level Price Adjustments, we discovered that actions lenders take now to help applicants raise their scores will have a marked impact on what the GSEs are willing to pay for the loans. Our analysis indicates that raising a score just one 20-point bucket can make a measurable difference in the lender’s overall profitability. Lenders who choose to send some of that back to the applicant can create a competitive advantage for themselves with no extra work. Good lenders are going to pay close attention to all the Cs that go into a wise underwriting decision. Industry leaders know how to focus on those they can impact. Currently, the only one that the lender can impact during the loan origination process is the applicant’s credit, which is why more lenders are adopting a credit first strategy to win more business.