MBA Chart of the Week June 5: Commercial and Multifamily Delinquency Rates Among Capital Sources

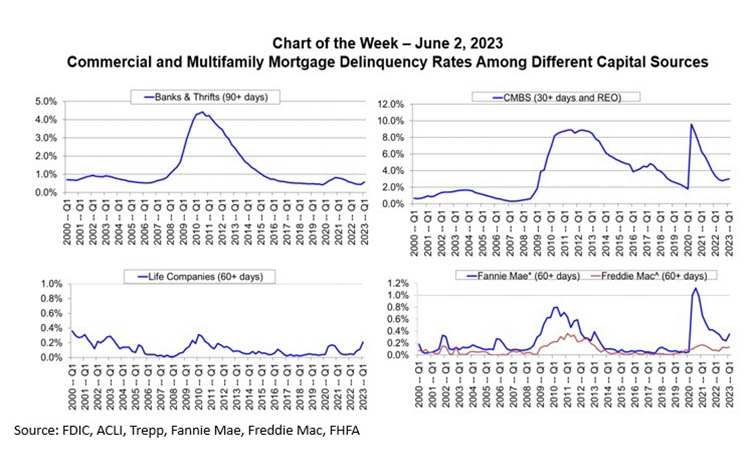

Ongoing stress caused by higher interest rates, uncertainty around property values and questions about fundamentals in some property markets are beginning to show up in commercial mortgage delinquency rates.

Given differences in their structures, each major capital source tracks delinquencies slightly differently – making them incomparable on an absolute level. Even so, delinquency rates increased for every major capital source during the first quarter, foreshadowing additional strains that are likely to work their way through the system.

Among bank-held loans, the 30+ day commercial/multifamily mortgage delinquency rate increased from 0.45 percent at the end of Q4 2022 to 0.58 percent at the end of Q1 2023. Freddie Mac’s 60+ day delinquency rate rose from 0.12 percent to 0.13 percent and Fannie Mae’s from 0.24 percent to 0.35 percent (Note that even Freddie and Fannie track delinquencies slightly differently). Life companies’ 60+ day commercial mortgage delinquencies rose from 0.11 percent to 0.21 percent. And among CMBS loans, the 30+ day delinquency rate, including loans in foreclosure and REO, rose from 2.90 percent to 3.00 percent.

For most capital sources, delinquency rates remain low by historical standards. But with 16 percent of outstanding loan balances facing loan maturities this year, the first edge of properties is just beginning to be pushed to adjust to today’s markets – with higher interest rates, uncertain property values, and questions about some property fundamentals. As they do, delinquency rates are likely to continue to rise.

But those adjustments should also bring greater market clarity – which should help pave the way for more transactions and a faster return to a stable commercial real estate finance market. In many ways, the faster that adjustment happens, the better for the overall market.