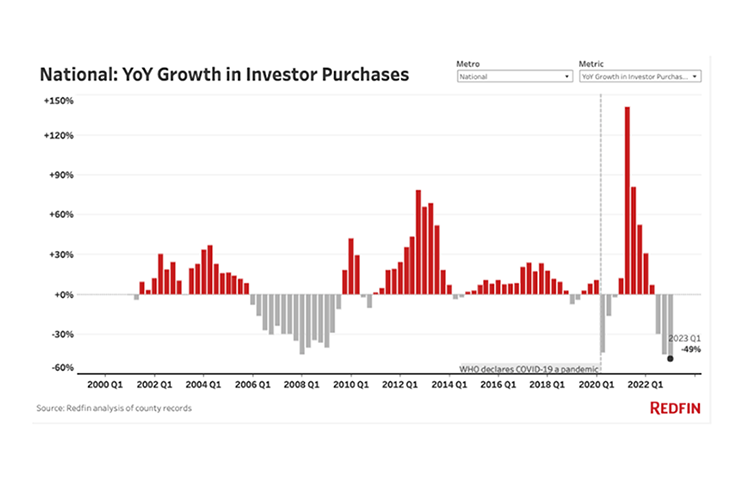

Investor Home Purchases Down Record 49% Year-Over-Year, Redfin Finds

(Courtesy Redfin, Seattle.)

Redfin, Seattle, reported real estate investors purchased nearly 49% fewer homes year-over-year in the first quarter, the largest annual decline on record.

That compares with a 40.7% drop in overall home purchases in 40 major metros tracked in the report. Quarter-over-quarter, investor purchases were down 15.9%, compared with a 14.7% decrease in overall home purchases.

Overall, investors bought $27.5 billion worth of homes in the metros tracked by Redfin in the first quarter, down from $51.2 billion one year earlier and down from $31.4 billion one quarter earlier, Redfin noted.

The firm attributed the year-over-year drop to elevated interest rates combined with declining rents and home values, among other economic factors. The report noted investor home purchases in Q1 2022 were near a record high; that also affected the size of last quarter’s drop.

While the rates are down, investors are still buying a sizable chunk of the market share. In Q1, they bought 17.6% of homes purchased in the metro areas Redfin tracked. While that’s down compared with 20.4% in the first quarter of 2022, Redfin noted it’s still higher than any quarter on record prior to the pandemic.

“While investors have pumped the brakes on home purchases, they’re still scooping up a bigger share of homes than they were before the pandemic, which can create challenges for individual buyers at a time when there are so few homes for sale,” said Redfin Senior Economist Sheharyar Bokhari. “Investors have gravitated toward more affordable properties due to still-high housing costs and rising mortgage rates, which has left first-time homebuyers with fewer starter homes to choose from.”

Low-priced homes made up 48.7% of investor purchases in the period, the most in two years. A record 41.1% of investor purchases were starter homes compared with 37.2% a year earlier. Redfin defined starter homes as those with 1,400 square feet or fewer.

Mid-priced homes were 23.6% of investor purchases, the lowest share in two years. The share of high-priced homes purchased by investors was little changed from recent quarters.

Geographically, the largest decline in investor home purchases was in Nassau County, N.Y., followed by Atlanta, Charlotte, N.C., Phoenix and Nashville, Tenn. The smallest declines were in Baltimore, Providence, R.I., Seattle, Milwaukee and Cleveland.

The data comes from a Redfin analysis of county records across 40 of the most populous U.S. metropolitan areas. Redfin defines an investor as any institution or business that purchases residential real estate.